Brokers Digest: Local Equities - Transport, MISC Bhd, ITMAX System Bhd, Malakoff Corp Bhd

This article first appeared in Capital, The Edge Malaysia Weekly on December 11, 2023 - December 17, 2023

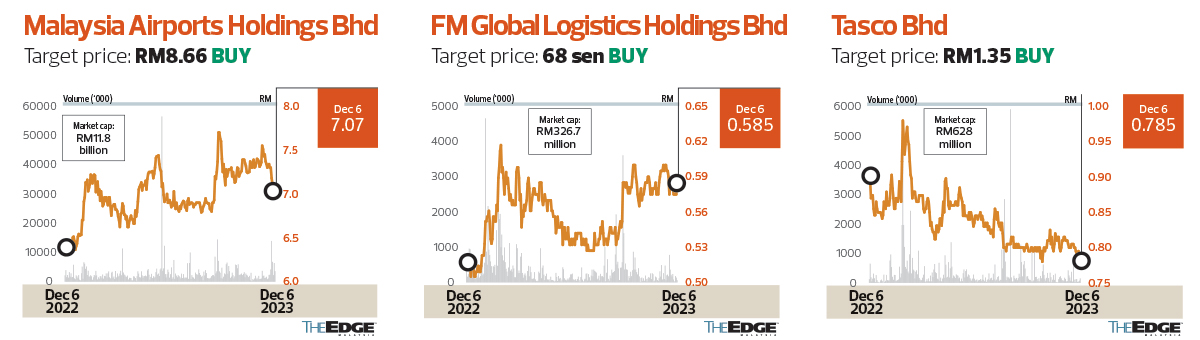

Transport

OVERWEIGHT

RHB RESEARCH (DEC 6): We upgrade the transport sector from “neutral” to “overweight”. The sector upgrade is underpinned by positive macroeconomic and sectoral indicators, namely emerging signs of recovery in China, a further pickup in tourism activities and stronger momentum in trade activities. RHB Economics expects trade momentum to strengthen beyond 4Q23, supported by the resilience of US and regional economies, global technology cycle rebound and early signs of recovery in China.

The 3Q23 core earnings of Westports Holdings Bhd (target price: RM3.60, “neutral”) were within our expectations, remaining relatively stable q-o-q but reflecting a 30% y-o-y improvement. This was attributed to a low-base effect, resulting from one-off expenses (Cukai Makmur and legal expenses with Oracle) incurred in 3Q22.

Malaysia Airports Holdings Bhd (MAHB) is regaining momentum in both its aeronautical and non-aeronautical segments. The stronger y-o-y performance was not a surprise to us, given the promising growth in both passenger traffic and recovery rates. However, earnings contracted 11% q-o-q due to the provision for doubtful debt for MYAirline, higher depreciation and increased user fee — in tandem with the increase in passenger traffic.

The confluence of reduced freight rates and subdued demand continues to erode margins of the freight forwarding business. FM Global Logistics Holdings Bhd’s 1QFY24 results were in line but recorded a -21.6% y-o-y drop, while Tasco Bhd’s 2QFY24 earnings were below expectations — both due to softer freight forwarding business volumes and slower-than-expected warehouse activities. Nevertheless, we expect Tasco to record a much better performance in 2HFY24 from maiden contributions of new warehouses, which should fetch wider margins compared to its current rented warehouse.

The 9M23 results of GDEX Bhd (target price: 12 sen, “sell”) fell short of expectations while 3Q23 marked another quarter of losses. The challenges stem from persistent intense pricing competition in the courier industry, slower-paced online activities and margin pressure from higher maintenance costs and operating expenditure.

We continue to favour MAHB and Tasco within the sector. Our preference for MAHB is premised on the anticipated recovery of international tourism — driven by the gradual recovery of China’s economy and increasing airline capacity.

Within the logistics sector, Tasco stands out for its diversified client base and business segments that will sustain its earnings base, as well as the integrated logistics services (ILS) tax incentives that offer a buffer against sector headwinds.

Downside risks to our sector call are a slower-than-expected recovery of trade activities and the tourism industry.

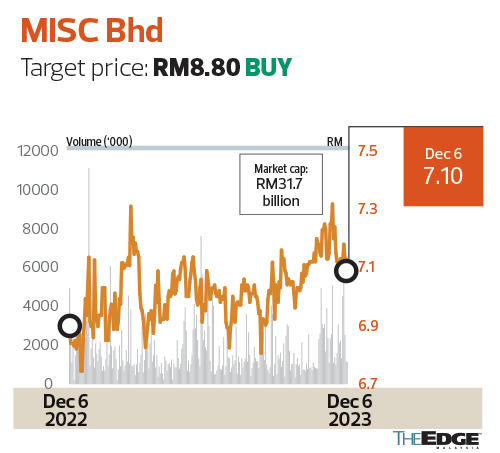

MISC Bhd

Target price: RM8.80 BUY

UOB KAY HIAN RESEARCH (DEC 6): As Bursa Malaysia’s largest shipping stock and a key global tanker conglomerate, MISC is committed to its net-zero 2050 pathway, with a target of 50% reduction in greenhouse gas (GHG) intensity emissions by 2030. A potential future ESG regulation risk is on sulphur emissions. Ultimately, these developments will likely prolong the tight vessel supply situation in the crude and LNG tanker segments. Hence, MISC should be a net beneficiary of the ESG trends, yet its share price has not adequately priced these in.

We believe MISC deserves to trade at the top end, due to its strong Ebitda from an upcycle in petroleum earnings, followed by a step-up in long-term earnings base from the Mero-3 floating production storage and offloading (to compensate for the cyclical nature of tankers) and further contract wins.

From a P/B perspective, MISC appears to be trading at a discount to its pure crude tanker peers worldwide, which are trading at four to five times forward PER but at high 1.3 times to 1.4 times P/B and this reflects the more persistent bullishness of the crude tanker upcycle.

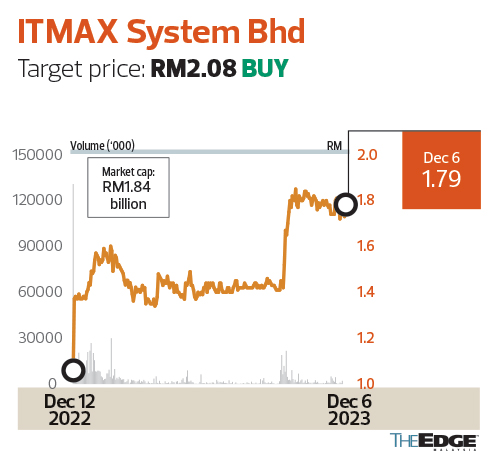

ITMAX System Bhd

Target price: RM2.08 BUY

HONG LEONG INVESTMENT BANK RESEARCH (DEC 6): Recall that ITMAX’s supply, install and maintain services (SINMS) revenue was up 25.4% y-o-y in 3Q23, thanks to the extension and increase in job scope for DBKL’s traffic system. ITMAX is optimistic that its smart project for the mechanical and electrical engineering contract for Segamat Specialist Hospital will pave the way for future collaborations with other private healthcare providers. The Johor Bahru, Iskandar Puteri and Pasir Gudang city councils are only three out of 16 councils in Johor and we expect all to come on board over time to realise the integrated smart city system.

The group secured a contract from MAHB in 3Q23 amounting to RM3.9 million for the supply and installation of aeronautical ground lighting control systems for six airports in Malaysia.

ITMAX has developed 27 AI features and is in the process of developing another 15 additional features. We believe this homegrown smart city integrated system and solution provider is a compelling case given its multi-year growth potential, on the back of solid order and tender books.

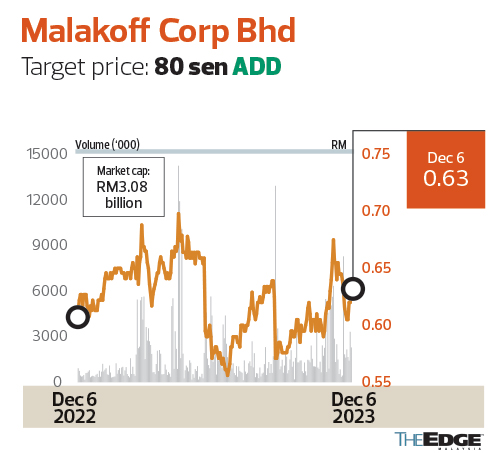

Malakoff Corp Bhd

Target price: 80 sen ADD

CGS-CIMB RESEARCH (DEC 5): We believe value has emerged following Malakoff’s 16% share price correction since mid-April, with the stock currently trading near its all-time low of 57 sen in June. At current levels, we think the market is overlooking the group’s strong free cash flow (FCF) generation once its earnings normalise, on the back of more stable coal prices.

Earnings delivery has been disappointing this year, with significant losses in 9M23, mainly due to the negative fuel margin. We estimate Malakoff will record a 2023F normalised net loss of RM534 million but expect earnings to rebound to a net profit of RM243 million in 2024F. We forecast FCF to expand from RM400 million in 2023F to a more normalised average run rate of RM1.3 billion in 2024F and 2025F. Thus, we see the prospect of higher dividends over the next two years from a cut in 2023F.

Key re-rating catalysts include earnings accretive renewable energy (RE) capacity expansion and a recovery in dividends going into 2024F. Downside risks include negative fuel margins remaining persistently high and unplanned plant outages.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

| AIRPORT | 10.200 |

| BURSA | 7.460 |

| CIMB | 6.610 |

| FM | 0.600 |

| GDEX | 0.165 |

| ITMAX | 2.190 |

| MALAKOF | 0.665 |

| MISC | 7.890 |

| TASCO | 0.825 |

| WPRTS | 3.930 |

Comments