Straits Energy sees telecommunications ringing up growth

This article first appeared in The Edge Malaysia Weekly on January 8, 2024 - January 14, 2024

AT a time when global crude oil prices are on the rise, ACE Market-listed Straits Energy Resources Bhd has shown its peers the benefits of diversification. In 2021, the group began the process of diversifying from oil trading and fuel bunkering services into the telecommunications and network services business as a new growth engine.

“Diversification is something that we have been planning for a while to grow the group’s earnings. In line with the growing trend towards enhanced connectivity, we believe that telecommunications is a good business to go into,” its executive director Datuk David Yoong Leong Yan tells The Edge in an interview.

“At the end of the day, it’s about getting the right people to run the business and we have been working over the last two years to put the team together,” he adds.

Last year, Straits Energy via its 75%-owned subsidiary Straits Technology Solutions Sdn Bhd secured almost RM120 million worth of contracts, for a port operator, township development, building operator and a university, among others, indicating that demand for network enhancement is on the rise.

This is in stark contrast to the RM2.6 million worth of contracts secured during its first year of operation in 2022.

The telecommunications and network services segment is still loss-making at this juncture, recording losses of RM1.92 million for the first nine months ended Sept 30, 2023 (9MFY2023).

Nevertheless, Yoong is optimistic that with the current pipeline of contracts, the segment will experience significant growth in 2024 and 2025.

“Our initial target is to secure at least RM15 million worth of contracts in 2023. Presently, we have about RM120 million worth of contracts spanning six to 24 months.

“We foresee the telecommunications and network services business to be one of the core businesses for Straits Energy as there is a lot of potential for growth and increasing demand. I will not be surprised if the telco business [eventually] surpasses the bunkering segment in terms of contribution,” he says.

Looking regional

To capture growing demand, Straits Technology Solutions CEO Sunny Ho Khin Choy says the group does not rule out looking outside of Malaysia for expansion.

“Our regional projects will probably come this year and we are currently in the midst of opening up a subsidiary in Cambodia, where we got an invitation from our customers to set up shop there.

“The next country we are looking at is the Philippines because they are now moving very fast into these smart city and smart building developments,” he adds.

Ho points out that Straits Technology Solutions’ telecommunications and network services include the use of artificial intelligence (AI) tools to improve network connectivity, which can advance security measures, data collection and analysing patterns for better resource allocation.

Essentially, under this division, Straits Technology Solutions can provide organisations with end-to-end solutions to meet their emerging communications and Internet of Things system and network needs, which include a cellular and wireless network, public or private network, and Smart Technology functional requirements for buildings, campuses, ports and industrial parks.

“For instance, one of our projects is to build a smart port powered by AI that will allow better surveillance and monitoring of ships that come to the port. This will optimise port operations and avoid bottlenecks during peak hours,” he explains.

Ho, who is the brother of Straits Energy group managing director Datuk Seri Ho Kam Choy, has more than 30 years’ experience in telecommunications. Prior to joining Straits Energy, he led various key sections in Digital Nasional Bhd, Axiata Group Bhd’s Edotco, Nokia Malaysia and Ascom, among others.

Straits Energy started its journey into the telecommunications and networking sector in 2021, following the acquisition of a telecommunications engineering company that year and an internet service provider in 2022.

Straits Technology, meanwhile, completed the acquisition of 70% equity interest in Straits CommNet Solutions Sdn Bhd in December 2021. Subsequently on Dec 16, 2022, Straits Technology entered into a share sale agreement with ViewQwest Sdn Bhd for the acquisition of 70% equity interest in Macro Lynx Sdn Bhd.

Ho says the group is also looking at potential merger and acquisition targets to support the growing demand for the group’s telecommunications and network services.

“This year, we are also looking to expand our services into data centres specialising in AI and are currently in talks with a potential partner, whereby we will provide the IT solution.

“The current data centres that we see are dedicated spaces or buildings that house organisation data, servers and IT equipment, where the organisation can draw on its data centre resources to operate its business. An AI data centre on the other hand does much more, from security, energy management and capacity management to running AI execution workloads” he adds.

Bunkering business remains core

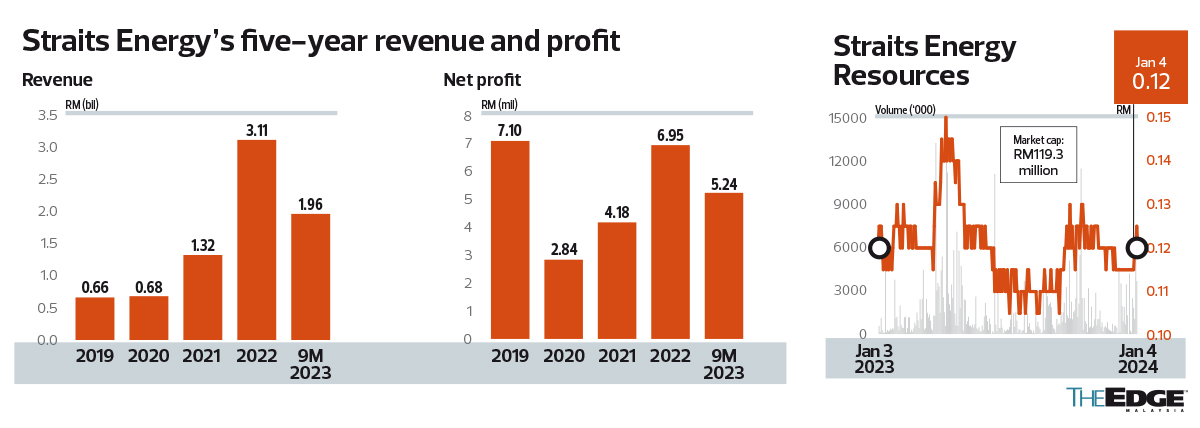

Currently, the oil bunkering segment contributes 99% to Straits Energy’s revenue. The group saw a 10.3% decline in net profit to RM5.24 million for 9MFY2023, from RM5.84 million a year earlier. This was on the back of a lower revenue of RM1.96 billion, which fell 17.7% year on year from RM2.38 billion in 9MFY2022 on lower crude oil prices and a weaker ringgit against the US dollar.

A back-of-the-envelope calculation shows that the net profit margin for its bunkering business is about 2.8%.

Yoong believes the group’s top line and bottom line would remain resilient going forward, supported by its bunkering business and growth prospects of the telecommunications and networking division.

He expects demand for the bunkering business to remain stable in the coming years, but the boost will be coming from its diversification efforts.

“Bunkering will remain as the group’s core business. But in spite of the increase in volume, the margin is very thin. As such, we have been preparing for the diversification [to the telecommunications and network services business since] two years ago and working on building the infrastructure and management to capture the growth in the sector,” Yoong explains.

He adds that the telecommunications and network services could improve the group’s margins moving forward.

Straits Energy, formerly known as Straits Inter Logistics Bhd, was incorporated in 1996 and listed on Mesdaq — now known as the ACE Market of Bursa Malaysia — in 2005. It went into the oil bunkering business in 2015.

Kam Choy is currently the largest shareholder of Straits Energy, with a 10.27% direct stake and a 7% indirect stake.

Shares in Straits Energy have been flattish in the past one year and closed at 12 sen last Thursday, giving it a market capitalisation of RM119.34 million. The counter is currently trading at a historical price-earnings ratio of 20.4 times.

Straits Energy is in the midst of raising close to RM11 million via a private placement. It has completed the second tranche of the fundraising. About 80% of the proceeds have been earmarked for financing projects to facilitate the expansion and development of the telecommunications and network services segment. Another 20% will be used for working capital and to pay the fees for the exercise.

It is understood that the first tranche of the placement is already completed.

The group’s fixed deposits, cash and bank balances stood at RM46.97 million, while borrowings and leased liabilities totalled RM132.9 million as at end-September 2023.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments