Technology stocks rise amid Nasdaq's overnight gains

KUALA LUMPUR (Jan 19): Local technology stocks traded higher in Friday’s morning session, mirroring overnight gains on Nasdaq, amid a rally in chip stocks.

On Thursday, the Nasdaq 100 achieved a 1.5% gain, reaching a record high of 16,982.29, while the S&P 500 saw a modest increase of 0.89%, closing at 4,780.94.

Meanwhile, Bursa Malaysia's Technology Index rose by 1.04%, or 0.65 points, to 63.11 during Friday's noon break.

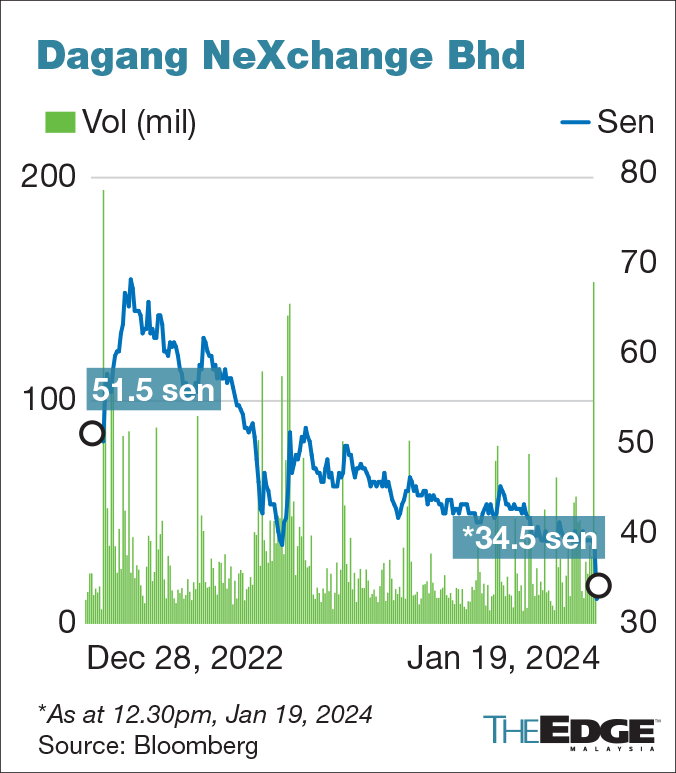

Dagang NeXchange Bhd’s share price increased by 4.55% or 1.5 sen to 34.5 sen, giving the group a market capitalisation of RM1.07 billion. It was the seventh most actively traded counter, with a trading volume of 41.37 million shares — 54% higher than its 200-day average volume of 26.9 million.

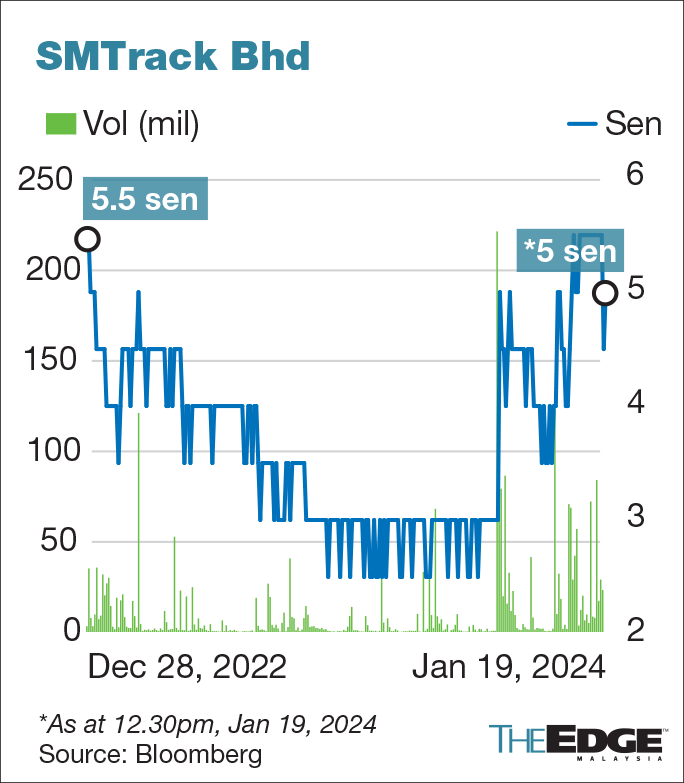

SMTrack Bhd, which was among the top 10 active stocks, rose half a sen or 11.11% to finish at five sen. At the current price, the group is valued at RM56.05 million. It saw some 23.26 million shares changed hands, more than double its 200-day average volume of 10.18 million.

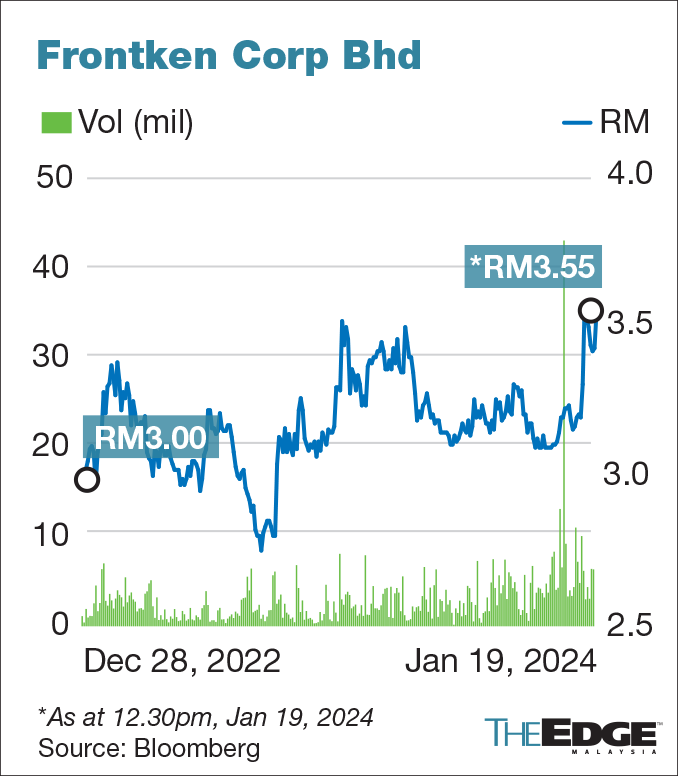

Frontken Corp Bhd, meanwhile, was the 11th gainer stock on Bursa. The counter settled at RM3.55 — 12 sen or 3.5% higher than Thursday’s closing price of RM3.43 — translating to a market capitalisation of RM5.61 billion.

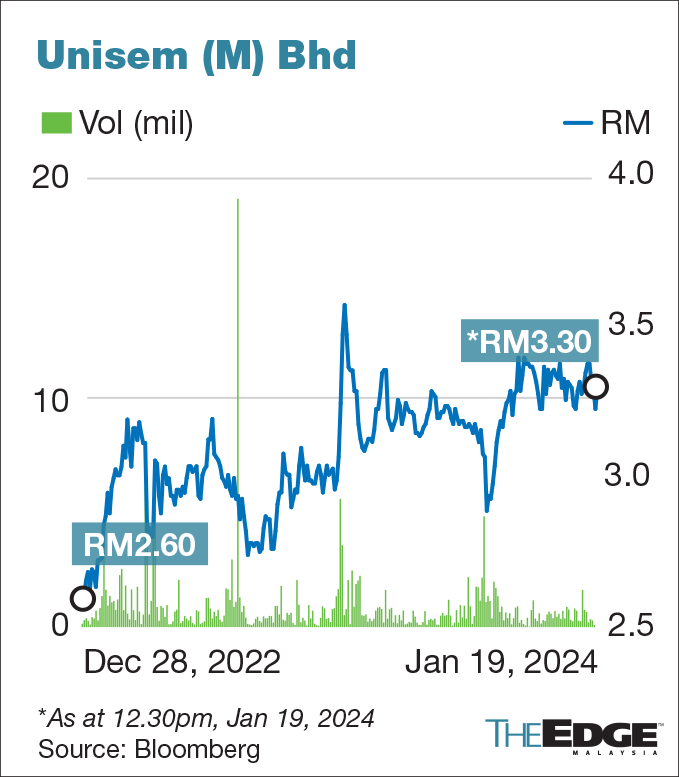

Also among top gainers was Pentamaster Corp Bhd, whose share price expanded seven sen or 1.65% to RM4.32, valuing the group at RM3.08 billion. Unisem (M) Bhd grew 2.17% to RM3.30, giving it a market capitalisation of RM5.32 billion.

Hong Leong Investment Bank Bhd said the technology industry is expected to gain by 14% in 2024 boosted by the strong recovery in memory. However, the forecast is too “bullish” at this stage as integrated circuit inventories remain high despite the downward trend in fab utilisation rate since the third quarter of 2022.

The research house kept its "neutral" stance on the technology sector, maintaining its cautious outlook due to unfavourable fundamentals in the short to mid term as well as stocks’ relatively high valuations compared to regional peers.

“Due to PC and smartphone’s large market shares of global semiconductor demand, their weaknesses are unlikely to be offset by the strength in HPC (high-performance computing) alone,” it said in a note dated Jan 5.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments