Sunsuria eyes healthcare and education as profit centres

This article first appeared in The Edge Malaysia Weekly on January 22, 2024 - January 28, 2024

OVER the years, property developer Sunsuria Bhd has been gradually diversifying into healthcare and education services. These two segments were initially intended to enhance the value of its property projects.

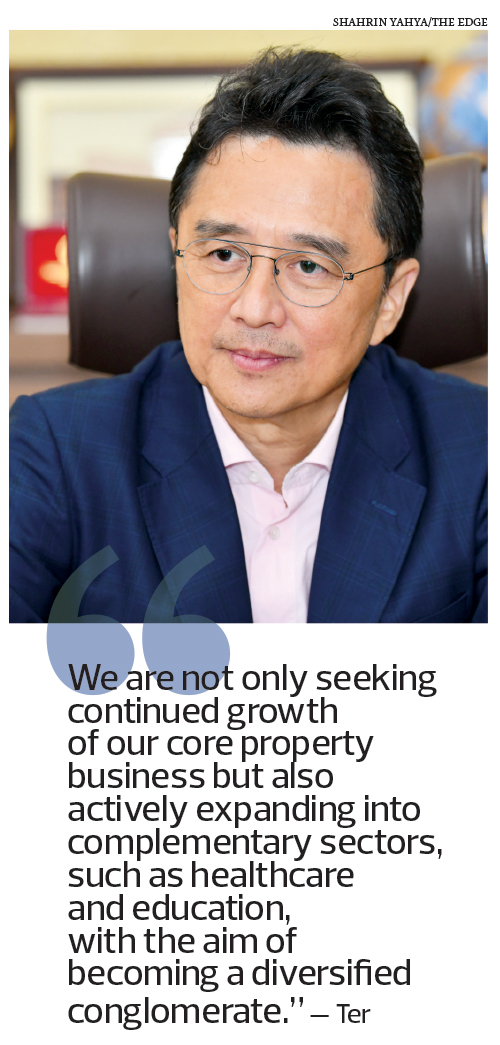

As Sunsuria’s teams in healthcare and education grow in size and maturity, however, the group’s founding executive chairman Tan Sri Ter Leong Yap wants both divisions to evolve from cost centres to profit centres in the future.

Ter tells The Edge in an interview: “In recent years, Sunsuria has undergone a transition period marked by strategic diversification into new business ventures, requiring resource allocation to these sectors. These ventures complement our core property business. As they mature and integrate into our diversified portfolio, we expect a positive impact on our overall financial performance.”

Sunsuria saw its net profit decline by 16% to RM13.86 million in the financial year ended Sept 30, 2023 (FY2023), down from RM16.55 million a year ago. As at Sept 30 last year, the group’s unbilled sales amounted to RM926.8 million.

Ter, 60, is hopeful that Sunsuria’s bottom line will bounce back soon. Moreover, he believes that the financial contributions of the healthcare and education divisions to the group will be as significant as that of property development in the coming years.

“While the prospects for the property industry are dynamic and evolving, Sunsuria has been strategically positioned to navigate these changes. As these new businesses gain traction and contribute to our overall revenue stream, we anticipate improved earnings performance,” he says.

“We are not only seeking continued growth of our core property business but also actively expanding into complementary sectors, such as healthcare and education, with the aim of becoming a diversified conglomerate.”

Ter is the controlling shareholder of Sunsuria, owning 60% of the property firm that he founded in 1989.

Interestingly, Ruby Technique Sdn Bhd — the private vehicle of QL Resources Bhd executive chairman Dr Chia Song Kun and his brothers-in-law Chia Seong Fatt and Chia Seong Pow — is also a substantial shareholder of Sunsuria with a 5% stake.

Meanwhile, Kossan Rubber Industries Bhd founder Tan Sri Lim Kuang Sia has a 1.08% stake in Sunsuria, and low-profile businessman Tan Sri Richard Koh Kin Lip owns 1.82%.

Another high-profile shareholder is Lion Group and Parkson Holdings Bhd chairman and managing director Tan Sri William Cheng Heng Jem with a 0.78% stake in Sunsuria, while his Lion-Parkson Foundation has a 0.36% interest.

It is worth noting that Sunsuria had on Aug 1 last year appointed Tan Wee Bee, former managing director of GuocoLand (M) Bhd, as its new group CEO.

Ter says Tan brings a forward-thinking approach that emphasises a comprehensive business strategy, positioning Sunsuria for sustainable growth.

“Tan’s seasoned experience in conglomerates aligns well with Sunsuria’s multifaceted business portfolio. Our expansion into various sectors presents both challenges and opportunities. His expertise in working within diversified groups equips him to navigate complexities and optimise Sunsuria’s expansion efforts,” he says.

Established in 2019, Sunsuria Healthcare Sdn Bhd operates primary care clinics, post-acute care and rehabilitation, and veterinary healthcare services.

In March last year, the company launched Sunsuria Care Hub at Sunsuria City, its flagship development in Sepang, in a move to improve healthcare and medical accessibility for its residents there.

“Managed by medical professionals, the Sunsuria Care Hub offers essential healthcare services and it is seamlessly integrated into Sunsuria City. We intend to replicate more of such elements in our future projects,” says Ter.

Sunsuria City is a 525-acre freehold integrated township development in Salak Tinggi, Putrajaya South, surrounding Xiamen University Malaysia, the first overseas university campus from China.

In October 2023, Sunsuria, through Icon Sunsuria Sdn Bhd, entered into a partnership with Island Hospital Sdn Bhd to set up its first cancer centre in Penang.

The centre, dubbed Icon Sunsuria Cancer Centre, commenced operations on Jan 2 and received “overwhelming response”, says Ter.

Icon Sunsuria, a joint venture (JV) between Icon Group — Australia’s largest cancer care provider — and Sunsuria Healthcare, aims to open more Icon Cancer Centres nationwide.

Ter points out that while Sunsuria Healthcare complements the group’s core property business, it is also charting its own path for development and growth. For instance, Icon Cancer Centre brings an international knowledge-sharing network of more than 300 oncologists and cancer industry partners, along with the latest approaches in clinical research, treatment techniques and drugs.

“Icon Sunsuria intends to tap into these resources to offer local hospitals and patients greater access to international clinical trials, as well as new proprietary drugs and technologies,” he says.

The healthcare segment is loss-making, turning in a consolidated loss before taxation of RM1.24 million for FY2023. Sunsuria’s profit contributor is the property development business, which made RM62.94 million in FY2023. Its two other business segments of construction and investment holding were in the red, with losses of RM859,000 and RM12.95 million respectively.

As at end-September 2023, Sunsuria’s net gearing stood at 0.31 times versus 0.17 times a year ago.

On the education front, Sunsuria had signed a collaboration agreement with Concord College International Ltd and Concord College, in the UK, as an exclusive partner in Asean to launch a new British international school for day and boarding students.

The group is now building Concord College Malaysia — the first Concord College International School in the region — in Sunsuria City. Occupying a 10-acre plot, it is slated to open in September this year.

Ter highlights that the new school will be led by Niel Hawkins, an accomplished Cambridge graduate and global principal of Concord College International, known for his inspirational teaching methods and creative leadership.

Notably, 83% of Concord’s 2021 graduates are currently enrolled in the UK’s top 10 universities, as ranked by the Times World Rankings.

“Our aim is to promote the school internationally and attract students from diverse backgrounds worldwide. This strategic initiative not only enhances the overall educational experience but also fosters a vibrant and inclusive environment,” Ter notes.

He says the expansion into healthcare and education aligns with Sunsuria’s vision for long-term sustainability and resilience.

“By diversifying our business portfolio, we can not only mitigate risks associated with market fluctuations but also create long-term stable income streams by tapping into opportunities in these sectors,” he adds.

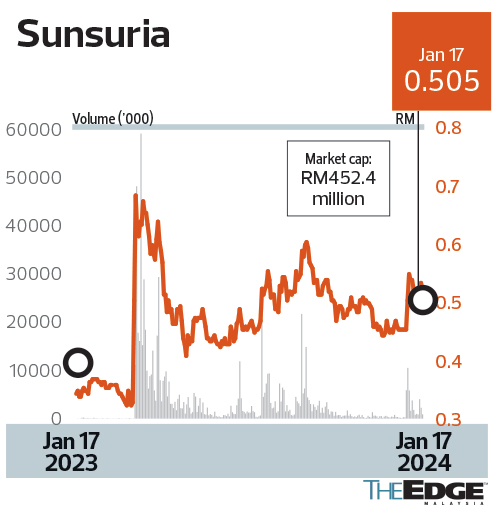

Over the past 12 months, shares in Sunsuria had gained 44% to close at 50.5 sen last Wednesday, giving it a market capitalisation of RM452.4 million. The counter is currently trading at a historical price-earnings ratio (PER) of 32 times and a forward PER of 16.41 times.

In April last year, Sunsuria’s stock price jumped to its highest level since the Covid-19 pandemic, when Prime Minister Datuk Seri Anwar Ibrahim secured RM170 billion in investments from China.

Back then, it was announced that Sunsuria had inked a memorandum of understanding (MoU) with IAT Automobile Technology Co Ltd, China’s largest independent car design company, to set up an operation base in Malaysia for electric vehicle (EV) manufacturing.

At present, says Ter, the joint venture with IAT Automobile is progressing well, and the project development is ongoing.

“We’re involved in conducting an extensive market study and, at this stage, we are unable to provide precise details. We have conducted thorough financial assessments, and we maintain confidence that this collaboration aligns with our long-term strategic vision and sustainability goals,” he adds.

On the property market, Ter says Sunsuria remains vigilant and adaptive in launching new projects.

“When it comes to launching new property projects, obviously, we have not been very aggressive in recent years. In fact, some people may deem us a little bit too cautious. But we believe our strategic initiatives will contribute to Sunsuria’s overall prospects, bringing resilience and value to our stakeholders,” he says.

Sunsuria owns a total developable landbank of 2,052 acres, with a potential gross development value (GDV) of RM8 billion, including the remaining GDV for Sunsuria City of RM5 billion.

Its resort-living condominium project, Bangsar Hill Park, has a GDV of RM3 billion, of which about RM1 billion has been launched.

This year, says Ter, Sunsuria plans to launch RM200 million to RM300 million worth of new projects in Sunsuria City, and a new phase worth RM500 million in Bangsar Hill Park.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments