Cover Story: Hong Leong Bank on mission to become country’s best-run bank

This article first appeared in The Edge Malaysia Weekly on January 22, 2024 - January 28, 2024

IF there was one thing Kevin Lam was sure of when he took the helm as Hong Leong Bank Bhd (HLBB) group managing director and CEO just over six months ago, it was that he had not been hired to do a business-as-usual (BAU) job.

In an exclusive interview with The Edge, the veteran Singaporean banker reveals that in one of his earliest meetings with HLBB chairman and key shareholder Tan Sri Quek Leng Chan, the tycoon made it clear that he expected transformative growth at the country’s fifth-largest banking group by assets.

“He said, ‘You’re not hired to do a BAU job’. His expectation is [that of] transformation,” Lam shares in a two-hour interview at the bank’s Kuala Lumpur headquarters in Damansara City, his first with the media since joining HLBB on July 1 last year.

Lam took over the reins from Domenic Fuda, who retired.

“He (Quek) felt that we were at an inflection point, where if we don’t move further up, then we likely will be pushed back. There’s a Chinese proverb about rowing the boat upstream; if your boat is not moving forward, then you’ll fall back. We’re at that point when the boat has to move forward against the current. So, we agreed that we needed to come up with a new plan for the bank.”

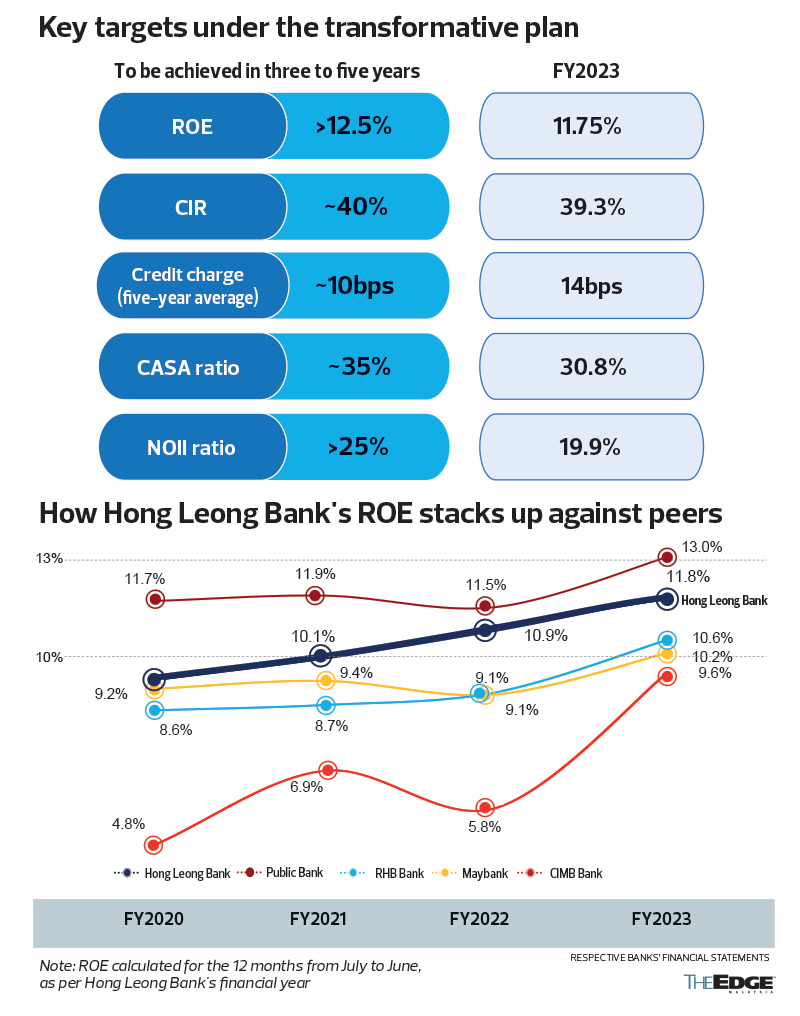

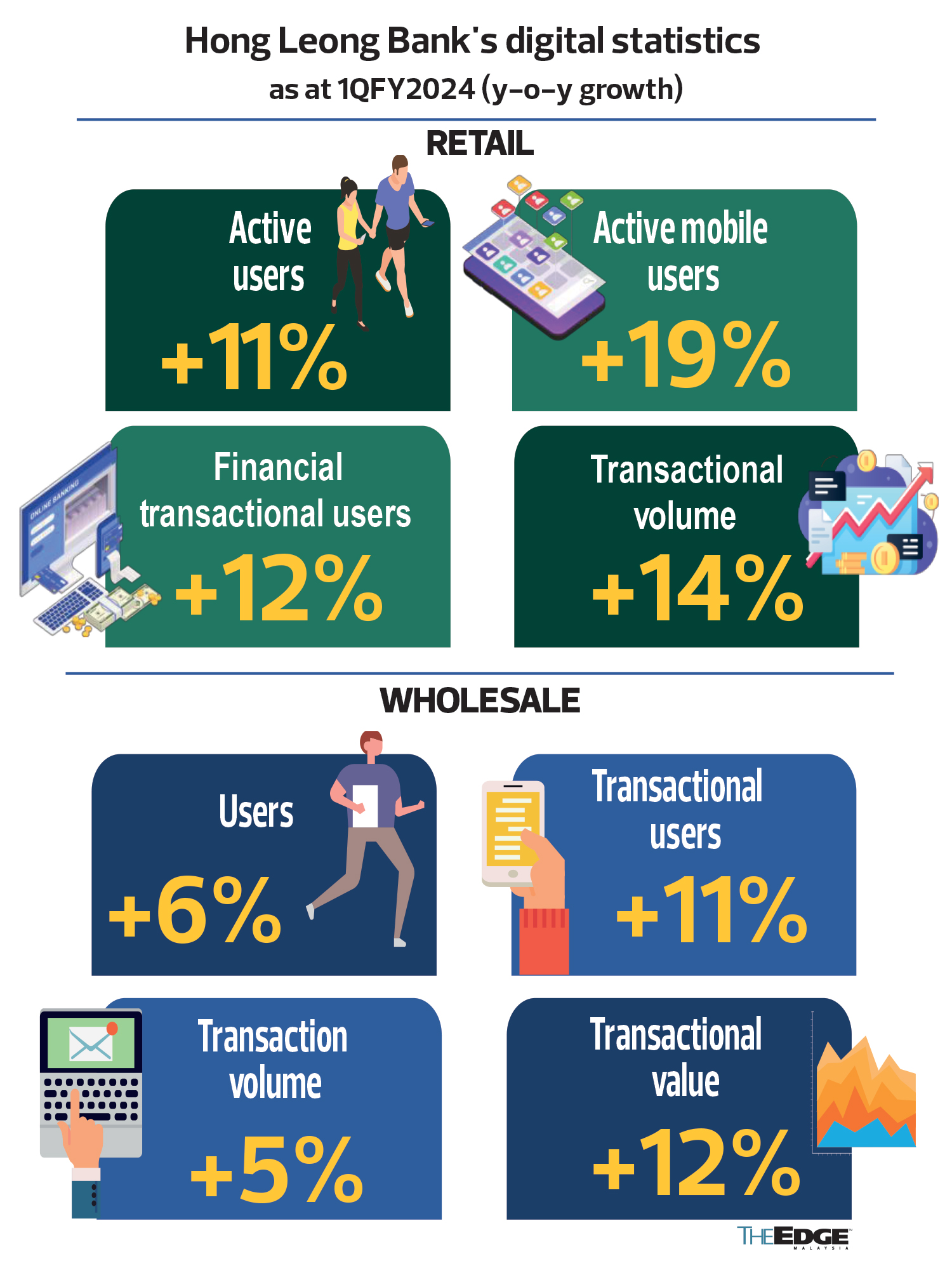

After months of working on it, Lam — previously the head of United Overseas Bank Ltd’s digital banking group TMRW — and his team finally unveiled what they call a “transformative” three- to five-year plan to the market in early December. Under the plan, HLBB aspires to be among the country’s top three banks by five key financial metrics, the most important one being return on equity (ROE).

Lam says the bank’s internal target is to achieve an ROE of 13% (versus its official target of “more than 12.5%”) by as early as its financial year ending June 30, 2026 (FY2026) — the third year of the plan — compared with 11.75% in FY2023.

The other targets are to increase its non-interest income (NOII) ratio to over 25% (FY2023:19.9%), lift the current account and savings account (CASA) ratio to around 35% (FY2023: 30.8%), keep its cost-to-income ratio (CIR) at around 40% (FY2023: 39.3%) and manage its credit charge-off rate at around 10 basis points compared with an average of 14bps in the last five years.

“Internally, we’re aiming to fast-track the five-year plan within three years,” Lam says, which means that the bank is striving to achieve all the five targets by the third year instead of the fifth.

This may seem a tad optimistic to some, considering the growing macroeconomic headwinds globally, including geopolitical conflicts and slowing growth in China — a market in which HLBB has exposure via its 19.8%-held associate Bank of Chengdu Co Ltd (BoCD) — as well as the increasingly competitive banking landscape at home, with new digital-only banks now in the mix.

To that, Lam says: “It’s all subject to the team [and] market conditions, but there’s certainly no lack of ambition and confidence from the team. More importantly, where the confidence and ambition come from are the chairman and the board.”

Ultimately, HLBB wants to become the best-run bank in the country. “We think to be the best-run bank, probably the best measure that we need to use is best-ROE, the return for our shareholders,” Lam says.

To put things into perspective, most analysts already view HLBB as one of the better-run banks in town. It ranks second only to Public Bank in terms of ROE, asset quality and cost management. HLBB’s ROE stood at 11.75% as at FY2023 as compared with Public Bank’s 13.1% as at the first nine months of last year.

“In terms of ROE, there’s only one [bank] ahead of us. We think that if we get our ROE to above 12.5% within that period of time [that is, by the third year], we should be close to being No 1,” Lam says.

Revving three engines for ROE uplift

According to Lam, the key thinking behind the transformative plan was that HLBB needs to maintain its strengths — that is, its lending business — while developing other business lines and capabilities that it hasn’t done as well in, such as NOII, which is now an important area of focus.

“HLBB has been very good at … lending money and making sure that we can collect it back, keeping credit cost low. But we need to develop other business lines, for example, wealth management and transaction banking.

“Within transaction banking also there are multiple and more detailed [areas] like cash management and trade. So, we need to develop all these to complement and work together with our lending business line, and then, from there, we will be able to get the NOII,” he explains.

For that to happen, there needs to be a change in the staff mindset about NOII, he says.

“I told the team: Don’t call it ‘ancillary’ income because the word in English means ‘by the way’, which [suggests that] if you get it, you get it; if you don’t, it’s not so key. So, I banned the term ‘ancillary income’. I said it’s called ‘franchise income’ [as] these things are part of the franchise.”

To make the point, he drew an analogy between the bank’s lending business and a McDonald’s meal. “If you sell the burger, you must sell it with the Coke and the fries, right, and the dessert — when all those products come together, then you get the margin. If you think of just selling the burger, the loans, you miss a lot of opportunity.”

To get the intended ROE, HLBB is counting on continued loan growth of 7% to 8% a year (FY2023: 8%) — which Lam thinks is achievable on the back of driving small and medium enterprise (SME) and overseas loans, in particular — as well as stronger NOII and higher CASA deposits.

“Loans were previously one-third of the engine [to lift ROE]. So, you need to add the other two engines, NOII and CASA. [With] a three-engine business running, then you have a better chance of hitting your ROE target,” Lam says.

Analysts believe HLBB stands a reasonable chance of hitting its five key financial targets, including ROE, in the next three to five years.

“The targets … do not appear to be unrealistic, considering that they are not far off from FY2023 levels. However, achieving a top three position will be challenging as the other peers will also be vying for higher ROEs in the next three to five years through various valued and business growth strategies,” AmInvestment Bank Research says in a Dec 6, 2023 report.

The big challenge and Singapore push

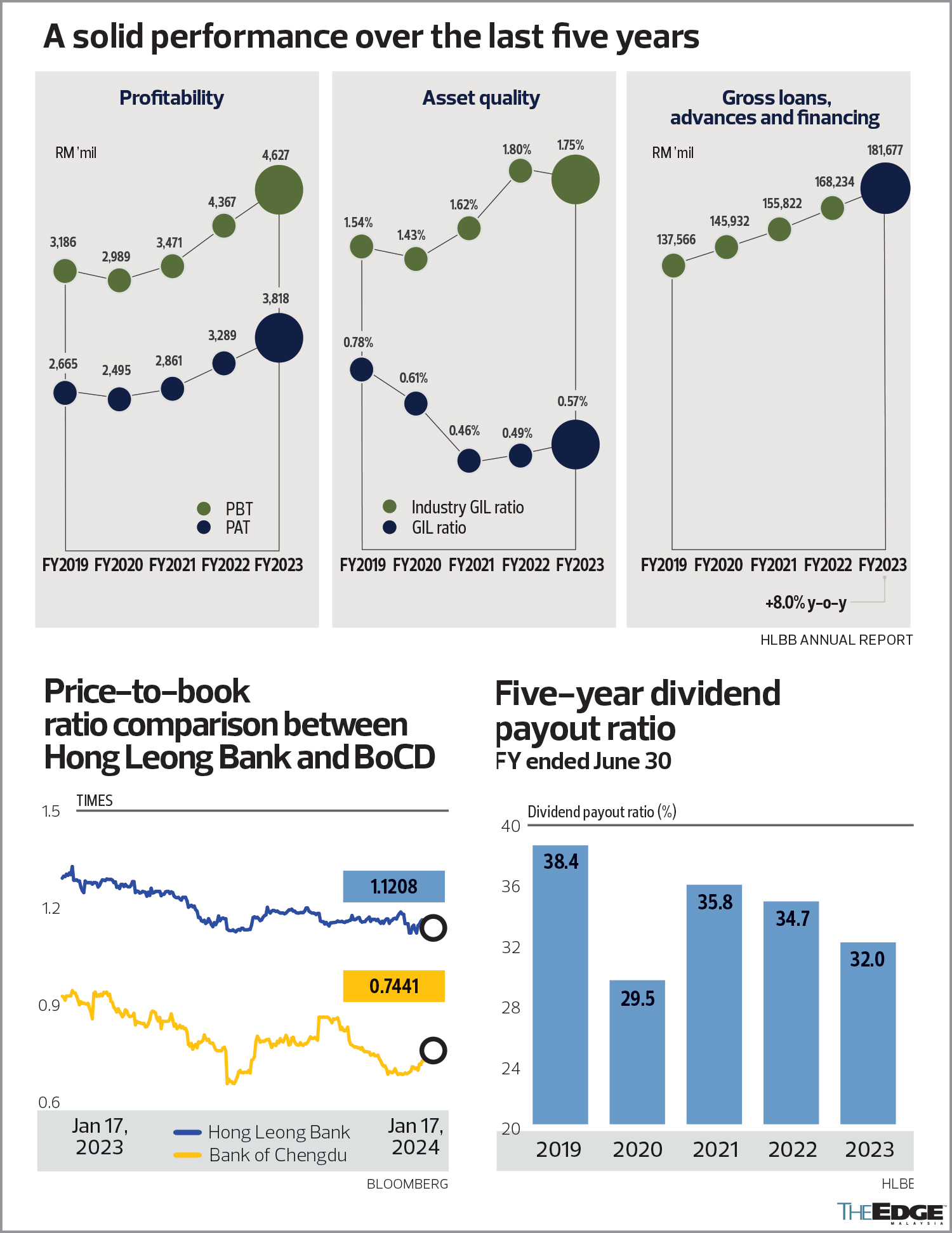

The strong growth of BoCD over the years — its earnings have been expanding at a five-year compound annual growth rate of 20.7% — and the Chinese associate’s solid contribution to HLBB’s bottom line, while positive for the group, are also becoming a challenge for Lam to manage.

BoCD accounted for 28.1% of HLBB’s RM4.6 billion profit before tax (PBT) in FY2023.

“It’s a very big challenge because BoCD is doing well,” Lam says. “My issue is, if it is growing so fast, the rest of my business cannot keep up with it. So, I need, in a way, to ensure that we moderate its contribution and let the other parts of our business catch up. That is my big challenge, I would say.

“That’s why I need to get Singapore and the rest of our overseas markets to all step up. Then, we have a chance of keeping apace.”

A key part of HLBB’s transformative plan is to lift the collective PBT contribution from Singapore, Vietnam, Cambodia and Hong Kong to about 7% in three to five years compared with 2.2% in FY2023. The focus is mainly on Singapore.

“Singapore features quite prominently in our plan. We have a branch and over 200 people there, and in the last four to five years, we’ve built up a sizeable commercial banking business. We still keep a very low credit cost there, near-zero NPL (non-performing loans) and have very high-quality customers,” Lam says.

“It’s actually doing close to about S$30 million [RM106 million] in PBT and in the five-year plan, we’re looking to grow it by more than three times to S$100 million,” he adds.

Despite it being a highly competitive market, he sees opportunities particularly in the commercial and SME banking space, as well as in wealth management.

Lam is also positive on HLBB’s operations in Vietnam, which recently turned profitable, but in Cambodia, there are still challenges to overcome as the largely US-dollar economy was impacted by the strong interest rate rises in the US.

“But we do see that [the US] could now be at the top end of the interest rate cycle, so we expect Cambodia will come back. [Our business there] was profitable before this interest rate cycle and at this point in time, it’s a near-breakeven business. So, that is also a potential contributor,” Lam says.

Not averse to M&A

According to Lam, HLBB’s three- to five-year plan does not feature inorganic growth.

“Ours is an organic plan,” he says.

Nevertheless, when pressed if the group would consider mergers and acquisitions (M&A) should there be such opportunities, he concedes: “We are always open [to them].”

Lam, however, declined to expand on the subject. Instead, he points out that HLBB is striving to become the country’s best-run bank, not the biggest bank.

Nevertheless, many wonder about potential M&A at HLBB, given that for a while now, Quek — a shrewd businessman whose other businesses include property and manufacturing — has been widely speculated to be looking into estate planning matters. In August 2022, Reuters, citing sources who declined to be named, reported that Quek — who turns 81 this year — was weighing options for his stake in HLBB, which could include a merger or a trimming of his stake.

He was ranked the country’s second richest person with a net worth of US$10.2 billion in Forbes’ “Malaysia’s 50 Richest” list in 2023.

The Quek-controlled Hong Leong Financial Group Bhd (HLFG) holds a 64.2% stake in HLBB. The lender’s second largest shareholder is the Employees Provident Fund, with a 9.5% stake as at Jan 15. HLFG, which derives about 90% of its bottom line from HLBB, also has two other core businesses, namely HLA Holdings Sdn Bhd (insurance and family takaful) and Hong Leong Capital Bhd (investment banking and asset management).

For now, all eyes will be on Lam to see if he can deliver on the three- to five-year plan that is ultimately aimed at generating higher returns for all shareholders.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments