Cover Story: Less dividends seen for GLICs in 2024 as special payouts wane

This article first appeared in The Edge Malaysia Weekly on March 11, 2024 - March 17, 2024

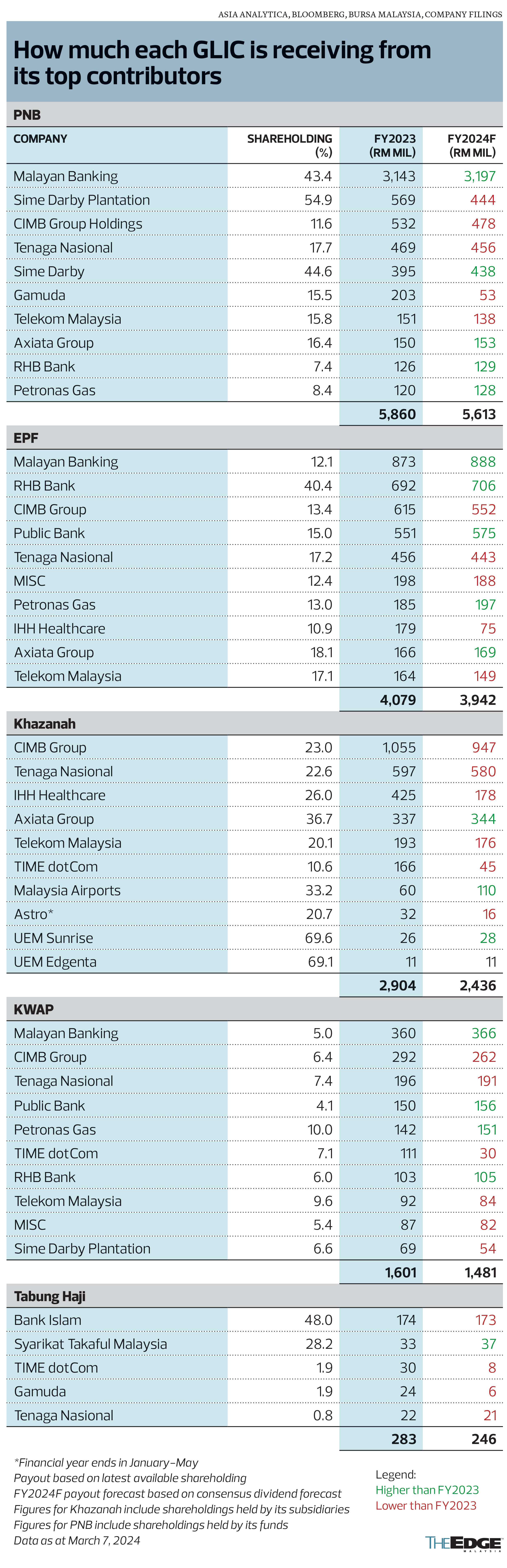

MANY Bursa Malaysia-listed companies are projected to pay better dividends in FY2024 but government-linked investment companies (GLICs) may collect less from their top contributors this year, with analysts projecting lower dividends compared with FY2023.

Of the top 10 dividend contributors to GLICs in FY2023, those expected to pay less in FY2024 include CIMB Group Holdings Bhd, Gamuda Bhd, IHH Healthcare Bhd and TIME dotCom Bhd — all of which paid special dividends in FY2023.

As a result, the cumulative dividends from the 10 companies to their GLIC shareholders look set to slip by 3.4% to 16% from FY2023, even though analysts currently see marginally higher dividends from Malayan Banking Bhd, RHB Bank Bhd, Public Bank Bhd and Petronas Gas Bhd.

The comparison is made based on analysts’ FY2024 dividend forecasts on these companies, and assuming no change in the shareholdings held this year by the GLICs — Permodalan Nasional Bhd (PNB), the Employees Provident Fund (EPF), Khazanah Nasional Bhd, Kumpulan Wang Amanah (Diperbadankan) (KWAP) and Lembaga Tabung Haji.

Gamuda Bhd, which saw RM388 million paid in dividends to GLICs in FY2023, is expected to pay 75% lower dividends in FY2024 at 12.3 sen per share, down from 50 sen in FY2023.

Analysts also expect CIMB, which is providing RM2.5 billion to the GLICs, to pay 10% less dividends in FY2024 (38.6 sen, from 43 sen).

IHH, which is contributing RM702 million in FY2023, is expected to pay 58% lower dividends (7.8 sen, down from 18.6 sen), while TIME dotCom, which provided RM431 million to the GLICs, is expected to lower its dividends by 73% (to 23.1 sen, down from 85.8 sen) in the absence of a special dividend.

Also expected to pay weaker dividends are Tenaga Nasional Bhd (44.4 sen in FY2024, from 46 sen in FY2023) and Telekom Malaysia Bhd (TM) (22.8 sen, from 25 sen), which feature prominently in the portfolios of these GLICs.

Among the GLICs, the biggest hit would be Khazanah, being the key shareholder in CIMB (23%), TIME dotCom (10.6%), IHH (26%), Tenaga (22.6%) and TM (20.1%). The contributions of its top 10 companies would be lower by RM467 million, to just RM2.44 billion, from RM2.9 billion collected for FY2023, The Edge’s back-of-the-envelope calculations based on prevailing consensus forecasts show.

PNB, meanwhile, is expected to collect RM247 million less (at RM5.61 billion, from RM5.86 billion).

Aside from exposure to CIMB (13.4%), Tenaga (17.2%), TM (15.8%) and Gamuda (15.5%), the investment fund could expect to see lower collections from 55%-owned Sime Darby Plantations Bhd.

Concerns over the weather impact on production and palm oil prices have prompted analysts to slash SimePlant’s FY2024 dividend forecast to 11.7 sen, from 15 sen in FY2023. It would be its third consecutive year of year-on-year dividend decline.

The EPF, meanwhile, may see its top 10 investee companies by FY2023 contribution churn out RM137 million or 3.4% less — the least hit by percentage terms among the GLICs, thanks to its diversified nature of shareholding.

The decline in the contributions of those companies is expected to be supported by its shareholdings in Maybank (12.1%), RHB (40.4%), Public Bank (15%), Petronas Gas (13%) and Axiata (18.1%).

The impact to KWAP could be around RM120 million, but at a higher percentage decline of 7.5%, as six of its 10 biggest contributors in FY2023 may cut dividends this year.

Tabung Haji may see dividends lowered by RM37 million, with four of its five top contributors paying less, except for Syarikat Takaful Malaysia Bhd.

It remains to be seen whether the gaps will be filled by other investee companies that may outperform this year. Prior to this, among other top contributors to the GLICs were property players like Sime Darby Property Bhd, plantation outfits such as Kuala Lumpur Kepong Bhd and IOI Corp Bhd, as well as Petronas-linked KLCC Stapled Group.

Of course, in theory, a few of these top contributors may have some room to further reward shareholders through higher dividend payout ratios.

Among them are Maybank, which has a 75% payout ratio based on forecast FY2024 earnings and dividend per share. Its payout was 77% in FY2023.

Others include Khazanah-linked CIMB (56% in FY2024, from 66%), Tenaga (61%, from 96%) and IHH (40%, from 55%), although these companies have paid special dividends in recent years.

Should Maybank pay 80% of its projected FY2024 earnings to shareholders, this will bump up its contributions to 43% shareholder PNB by around RM215 million.

And if its peer CIMB raises its FY2024 payout ratio to 60%, this will add RM33 million to PNB’s payout. Combined, the two could potentially cover that RM247 million gap projected into PNB’s FY2024 collection, calculated based on analysts’ dividend forecast on the investee companies, assuming there is no change in shareholding.

Higher payout ratio among GLIC-linked stocks

Notably, companies with less GLIC exposure, but contribute sizeable amounts by virtue of their market capitalisation, generally have a lower payout ratio than the GLIC-controlled companies.

This includes Public Bank Bhd, which contributed RM701 million in dividends to GLICs in FY2023 (54% FY2024F payout ratio). Smaller contributors are Hong Leong Bank Bhd (33%) and YTL Power International Bhd, in which the EPF has a 5% stake and is expected to pay just 20% of its earnings as dividends in its financial year ending June.

Petronas-linked listed companies, too, have lower payout ratio forecasts by analysts, including Petronas Chemicals Group Bhd (49%, from 61%); KLCC Stapled Group (93%, from above 100% in recent years), Petronas Gas Bhd (79%, from over 80% in recent years); and tanker vessels operator MISC Bhd (65%, from 75%).

Having GLICs as shareholders “should provide stability in terms of requesting higher dividends, generally”, according to Malacca Securities head of research Louie Low Ley Yee.

Former stock dealer Ian Yoong concurs.

“Many GLIC-linked stocks have high dividend payout ratios as the GLICs (often the major shareholders) have to pay dividends to investors of funds managed by the GLICs,” he tells The Edge.

However, investors should consider that government-linked companies may have different purposes than just providing high dividends, says MIDF head of research Imran Yassin Md Yusof.

“GLICs also invest for capital gains and for strategic reasons [such as national interest],” he says. “It’s more about the function of the business, and which sector the companies are in.

“There are also companies without GLIC shareholding but do provide healthy dividends,” he adds, pointing to MIDF’s top picks from the dividend perspective, such as Matrix Concepts Holdings Bhd. The property group, which has Tabung Haji holding 5.2% and the EPF holding 4.7%, has a forward dividend yield of 5.7% based on March 7’s close.

Indeed, 28 of the 50 top-yielding stocks identified by The Edge do not have any GLIC as a substantial shareholder.

There is also a different perspective in investing than just going for the dividends, says Areca Capital CEO Danny Wong.

“I agree that GLICs would be a good reference for dividends. However, it is not so suitable for growth investing where, in general, we don’t expect a surprise upside from a large and mature entity,” he says.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

| BURSA | 7.460 |

| CIMB | 6.610 |

| GAMUDA | 5.250 |

| HLBANK | 19.260 |

| IHH | 6.270 |

| IOICORP | 4.050 |

| KLCC | 7.710 |

| KLK | 23.000 |

| MATRIX | 1.800 |

| MAYBANK | 9.790 |

| MISC | 7.890 |

| PBBANK | 4.210 |

| PCHEM | 6.870 |

| PETGAS | 18.020 |

| RHBBANK | 5.500 |

| SIMEPROP | 0.930 |

| TIMECOM | 5.260 |

| TM | 6.110 |

| YTLPOWR | 4.420 |

Comments