Rising tide shifts OSV players’ focus towards contract, vessel renewals

This article first appeared in Capital, The Edge Malaysia Weekly on March 18, 2024 - March 24, 2024

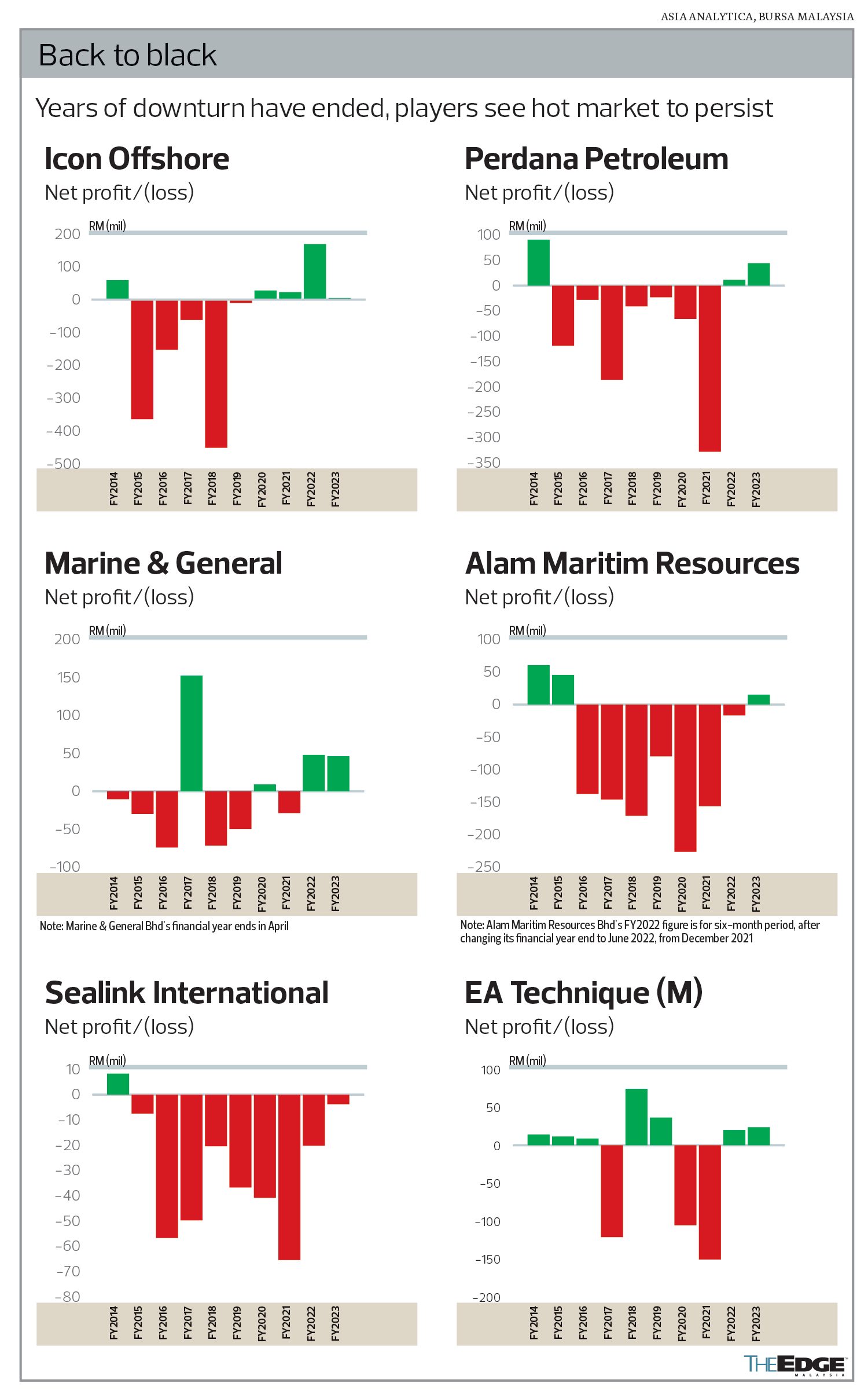

IT is official: Malaysia’s upstream oil and gas (O&G) industry is back in business. A number of service companies supporting the local waters posted their second profitable year in 2023, amid prevailing supply tightness and robust activity levels.

For a number of offshore support vessel (OSV) outfits, the focus now shifts towards getting their fleet into better shape to improve their chances of capturing more contracts ahead.

Discussions are continuing on the replacement of older fleet with newbuilds, according to industry players contacted by The Edge. Others are taking delivery of new vessels while disposing of older, smaller ones in similarly heated markets like India and the Middle East.

This as they prepare for Petroliam Nasional Bhd’s (Petronas) upcoming production operations vessels (POV) tender, for which awards have been delayed since end-2023.

“These (the POV awards) are expected to be 3+3 years’ contract awards for around 145 vessels across different sub-segments, with total contract value of more than RM2 billion per year,” says the CEO of a local vessel operator.

Beyond that, the industry is also anticipating the second phase of the Safina newbuild programme, a build-to-operate contract award first introduced by Petronas in 2021.

The first phase in 2021 saw contracts with a long-term charter period of 7+3+3+2 years (a total of 15 years) awarded. However, only 11 vessels were built locally under the first phase, out of the 16 tendered (and 100 projected across the entire five-year programme), suggesting that there is still a big slice of the pie to be given away.

Phase two of Safina is expected to be tendered as early as the third quarter of this year (3Q2024). Industry estimates for the awards range from the teens to more than 20 vessels up for grabs.

Revisiting fleet expansion

Malaysia currently has around 250 to 270 local-flagged vessels serving the O&G industry, says Malaysia OSV Owners’ Association (Mosva) president Jamalludin Obeng.

This compares with the local requirement of over 300 vessels under the current market environment, he says.

As both service providers and oil companies are on firmer footing, “now is the right time” for the industry to seriously look into fleet replenishment, adds Jamalludin, who is also managing director of Perdana Petroleum Bhd.

“We expect the [demand] momentum to continue,” he says. “There are not enough vessels out there.”

The existing fleet is also shrinking. About 80% of all Malaysian vessels supporting the O&G industry are old vessels, aged above 11 years, according to Mosva data. It is noted that Petronas in 2022 extended vessel operating life to up to 20 years, from 15 previously, as demand exceeded supply owing to sustained activity levels.

The local industry prioritises Malaysian-flagged vessels, but the capacity shortage is covered by foreign vessel owners. Earlier studies have shown that this shortage amounts to around RM1 billion in annual market lost opportunity for local players.

Despite the landscape turning favourable for OSV players, it is not yet a super-cycle for them. Petronas is managing costs by closely monitoring the scheduling of local offshore services across its assets and among production sharing contracts (PSCs) in order to ensure sustained supply, thus reducing market volatility.

Banks are also still selective in funding newbuilds, according to Mohamed Safwan Othman, president and group managing director of vessel outfit Dinastia Jati group.

Apart from Safina, the absence of long-term contracts still poses a challenge for local players in obtaining support from financial institutions, although the Petronas Activity Outlook — which projects industry demand across a three-year period — helps, says Mohamed Safwan.

“Of course they (the banks) are opening up a bit to companies with long-term track records and healthy financials … They know that demand is high. But I would say the banks would finance just a portion of the opportunities.”

Dinastia Jati has disposed of two vessels and is building up to six new vessels as part of its OSV fleet renewal that is currently 10 vessels strong, says Mohamed Safwan. “Our projection shows that we need to double our fleet of fast crew boats (FCBs) and other categories of OSVs, but banks are only willing to finance 50% of that,” he adds.

The cautious sentiment is likely the result of lessons learnt from the previous O&G downturn. Gone are the days when OSV players build their vessels first and seek out charter jobs later, at the risk of being caught flat-footed with no contract to finance the vessel on hand.

Healthy pipeline

As vessel owners have regained the appetite to expand for the first time in a decade, the obvious next question is what happens if the market turns pear-shaped again?

Mohamed Safwan, who is also chairman of Malaysia Shipowners’ Association, points to the base-case scenario on days of low oil prices. “When prices were at US$30/bbl, there were 150 vessels still required by the Malaysian market, which is about half of the current fleet in operation.

“[Capacity preparation for] anything additional to that is based on the risk appetite of each company. We believe the market will remain hot for the next three years,” he says.

Notably, spot daily charter rates (DCR) in Malaysia have yet to fully catch up with other regions despite having recovered to pre-downturn levels.

Recall that in 2022 and 2023, Petronas revised upward its charter rates. Although not as high as in other regions, the reversal back towards levels seen in 2010s have been largely welcomed.

Petronas has also revised its vessel demand forecast upward by 19% to 397 in 2024, from 333 projected previously. This is expected to slow down to 373 in 2025 (from the initial projection of 329 vessels) and 316 in 2026, according to its latest Activity Outlook.

Its domestic capital expenditure has improved year on year in 2023, and president and group CEO Tan Sri Tengku Muhammad Taufik, in a recent briefing, confirmed that the national O&G company is not slowing down its exploration activities.

Among listed OSV players, those that have completed their restructuring, such as Naim group-linked Perdana Petroleum and Permodalan Nasional Bhd-linked Icon Offshore Bhd, have shown better financials.

Icon, managing a fleet of 18 OSVs with an average age of 14 years, has paid out dividends for two consecutive years, with the payout yielding 8.2% based on last Thursday’s closing price of 60.5 sen.

Perdana Petroleum, whose fleet has an average age of 13 years, plans to start its fleet renewal in these two years, Jamalludin said in an interview in January.

Marine & General Bhd, which has been profitable in three of the last four years, sees “vessel utilisation and charter rate increase to continue in the current financial year, although at a slower rate than the preceding financial year”, it said in its latest results. The company owns 70% in Jasa Merin (M) Sdn Bhd, with the Terengganu government owning the other 30%.

Sealink International Bhd, while yet to reverse its nine-year loss-making streak, has posted its best bottom line since FY2014. The company, which also builds and repairs vessels, sees 2024 as “a bright year” for the industry and is “looking forward to secure more new charters”.

EA Technique (M) Bhd (EATech), en route to exiting PN17 with two quarters in the black, and pending a decision by Bursa Securities on a regularisation plan to raise RM71.62 million in equity, will see businessman Datuk Mubarak Hussain Akhtar Husin and founder and executive deputy chairman of Kinergy Advancement Bhd Datuk Lai Keng Onn emerge as its largest shareholders.

Alam Maritim Resources Bhd, which turned profitable in FY2023, remains under PN17. The group has until Sept 25, 2024 to come up with a scheme of arrangement with its creditors, and until April 30, 2024 to submit its regularisation plan to Bursa Securities. As at end-2023, it had RM100.64 million of short-term borrowings, against cash of RM32.68 million while its total equity including non-controlling interests stood at a deficit of RM53.91 million.

Sometime yet to decarbonise

Another consideration for fleet renewal — which needs a long-term view of around 15 years — is the emerging interest for greener vessels that produce less emissions.

Petronas is on track towards achieving its emissions targets in 2024 and 2025. There is rising scrutiny on its Scope 2 and Scope 3 emissions (indirect emissions including from stakeholders along its value chain) which may trickle down to service providers such as OSV owners in the future.

“We are quite serious in ensuring that the next-generation vessels should be built with engines that are ready to be converted [to utilise] green energy,” says Mosva’s Jamalludin.

The first phase of Petronas’ Safina programme still allows the use of conventional technology.

However, industry associations such as Mosva and the Association of Marine Industries of Malaysia are revisiting the prospects of greener vessels, as well as fuel efficiency in larger vessels such as the anchor handling tug supply (AHTS) vessels and platform supply vessels (PSVs), especially for Safina phase two.

While financing for greener vessels is easier to access and cheaper, the vessel itself could be up to 20% more expensive.

At the moment, the Malaysian market has yet to go all out on vessel emissions, allowing some time for vessel operators to explore decarbonisation, compared with markets like the North Sea.

Many Malaysian vessels also use marine gas oil, which has among the least carbon emissions across conventional marine fuel types.

To Dinastia Jati’s Mohamed Safwan, it boils down to what clients need. “We are fully supportive of the net zero carbon way forward, and working with our peers in the industry on the latest green technologies.

“Current charter rates are high and new technology, of course, comes with a bit of a premium,” he says. “There are some ways to go before the technology matures and becomes cheaper.”

Return of investor interest

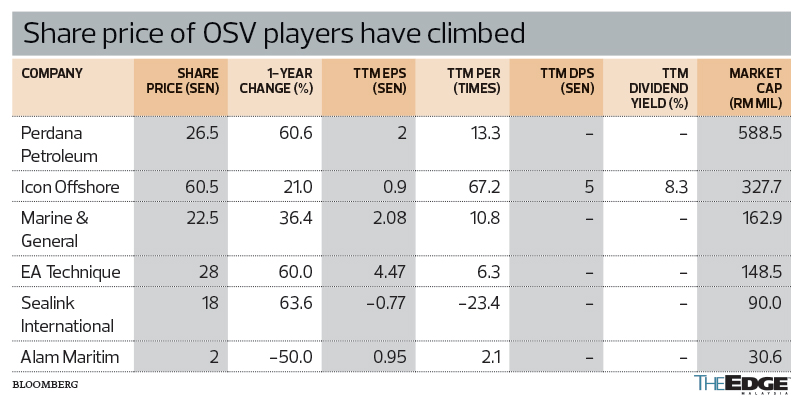

Shares of Perdana Petroleum, EATech and Sealink have rallied over 60% in the past year, followed by Marine & General (36%) and Icon (21%).

Perdana Petroleum is trading at a historical price-earning ratio (PER) of 13 times, followed by Marine & General (11 times). An average forward PER of 10.2 times was observed among Malaysian and Singaporean-listed OSV companies during the 2010-2014 upcycle, according to Kenanga Research.

Icon, the only player with analyst coverage, has an average target price of 75 sen against its March 14 close of 60.5 sen based on two analysts — Kenanga Research with a “buy” call of 80 sen, and Maybank IB Research with a “hold” call at 71 sen.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments