Insider Moves: Pan Malaysia Holdings Bhd, AMMB Holdings Bhd, Eden Inc Bhd, Econpile Holdings Bhd, Public Bank Bhd, Matrix Concepts Holdings Bhd

This article first appeared in Capital, The Edge Malaysia Weekly on March 18, 2024 - March 24, 2024

Notable filings

During the week of March 4 to 8, notable changes in the shareholding of companies publicly traded on Bursa Malaysia included those at Pan Malaysia Holdings Bhd.

Exsim Hospitality Holdings Sdn Bhd triggered a mandatory general offer (MGO) after it acquired 612.12 million shares, or 65.9% equity interest, in Pan Malaysia Holdings on March 7, buying the block from businessman Tan Sri Khoo Kay Peng for RM36.73 million, or six sen per share.

The offer price of six sen is a 47.83% discount to the 11.5 sen at which the Pan Malaysian Holdings shares were trading prior to the offer. The offer price is also a 50.78% discount to Pan Malaysia Holdings’ one-month volume-weighted average market price of 12.19 sen.

Exsim Hospitality, the vehicle of brothers Lim Aik Hoe, Lim Aik Fu and Lim Aik Kiat, is part of the larger Exsim group, which has a sizeable property development business. Meanwhile, Pan Malaysia Holdings has sold most of its assets, including a 34% stake in stockbroker Pan Malaysia Capital Bhd and PM Asset Management Sdn Bhd, and now holds only the 200-room Corus Paradise Resort Hotel in Port Dickson, Negeri Sembilan.

Pan Malaysian Holdings’ share price surged to as high as 28 sen intraday before closing at 20 sen last Wednesday (March 13), translating into a market capitalisation of RM185.8 million.

Elsewhere, ANZ Funds Pty Ltd of Australia, which is controlled by ANZ Group Holdings Ltd — Australia’s fourth-largest financial services group by assets — hived off 545.83 million shares, or 16.5%, in AMMB Holdings Bhd at RM3.85 each, or RM2.1 billion, on March 6. AMMB Holdings wholly-owns AmBank (M) Bhd, the sixth-largest banking group by assets in Malaysia.

After the sale, ANZ Group is left with a 5.17% stake, or 171.01 million shares, in AMMB Holdings. The buyers of the 16.5% stake are understood to be several funds. ANZ Group initially acquired a 13.5% stake in 2006 for RM1.07 billion, or RM3.05 per share, but eventually upped its shareholding to 24% in 2007.

AMMB’s share price closed at RM4.02 last Wednesday, valuing the company at RM13.3 billion.

During the week in review, Koperasi Belia Islam Malaysia Bhd continued to pare down its equity interest in Eden Inc Bhd, reducing its stake by 2.26 million shares to 37.91 million shares, or 8.25% equity interest.

In September 2023, Koperasi Belia Islam Malaysia emerged as a substantial shareholder of Eden with 27.41 million shares, or a 5.97% stake, and strengthened its shareholding in the food and beverage, tourism, energy and manufacturing outfit to 56.96 million shares, or 12.4%, by mid-November last year before paring down its stake.

Eden’s share price hit a multi-year high of 27.5 sen at end-November last year but had since shed 40% to close at 16.5 sen last Wednesday, giving the company a market value of RM75.8 million.

Over at Econpile Holdings Bhd, Kumpulan Wang Persaraan (Diperbadankan), or KWAP, ceased to be a substantial shareholder after selling 2.56 million shares on March 7. KWAP emerged as a substantial shareholder of Econpile last October with 74.17 million shares, or a 5.23% stake. The stock has almost doubled in value over the past year. It closed at 42.5 sen last Wednesday, giving the company a market capitalisation of RM602.4 million.

Notable movements

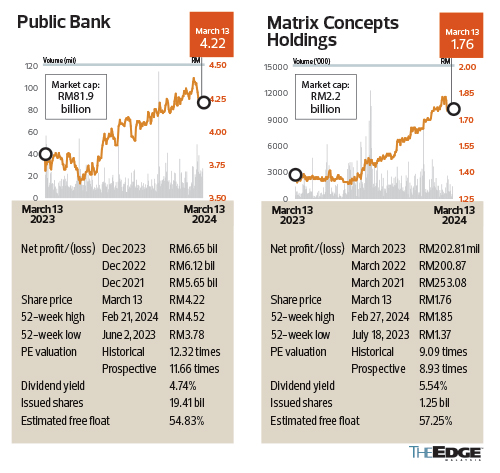

Public Bank Bhd’s share price hit a multi-year high of RM4.52 intraday on Feb 21, representing a gain of more than 9% in a span of about two months. Since then, the stock has given up 7% of its gains.

The banking group announced at end-February that its net profit for FY2023 had fallen 5.7% to RM1.62 billion as a result of higher allowances for loan impairment and higher operating expenses as well as lower net interest income.

The Employees Provident Fund (EPF) has been actively trading Public Bank’s stock and acquired 28.21 million shares during the week in review to raise its shareholding to 2.95 billion shares, or 15.19% equity interest.

Property developer Matrix Concepts Holdings Bhd’s share price hit a historical high of RM1.85 intraday on Feb 27, representing a gain of about 12% since the start of the year. The stock had since tapered off to end at RM1.76 last Wednesday.

Pilgrims fund Lembaga Tabung Haji emerged as a substantial shareholder of Matrix in late November 2023, after accumulating 62.6 million shares, or 5% equity interest. Since then, the fund has been nibbling at the stock. During the week in review, it acquired 1.05 million shares, nudging its shareholding to 65.6 million shares for a 5.24% stake.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments