Insider Moves: Pelikan International Corp Bhd, IJM Corp Bhd, Eversendai Corp Bhd, Hong Seng Consolidated Bhd, Malaysia Airports Holdings Bhd, Kossan Rubber Industries Bhd

This article first appeared in Capital, The Edge Malaysia Weekly on April 1, 2024 - April 7, 2024

Notable filings

For the week of March 18 to 22, notable changes in the shareholding of companies publicly traded on Bursa Malaysia included that at stationery distributor Pelikan International Corp Bhd.

Merit Plus Ventures Ltd, a unit of Ikhlas Capital Singapore Pte Ltd, ceased to be a substantial shareholder on March 18 after disposing of 34.06 million shares, or a 5.65% stake, in the company via a direct business transaction.

The stake was likely acquired by Pelikan president and CEO Loo Hooi Keat, as stock exchange filings show that he picked up a similar number of shares on the same date the shares were sold. The move bumped up the businessman’s shareholding to 23.88%.

Late last year, Pelikan and its subsidiaries disposed of the group’s main asset — German-based stationery producer and distributor Pelikan Group GmbH — to Holdham SAS of France for about RM695.44 million. The bulk of the proceeds were then returned to shareholders via a proposed distribution. The group is now a distributor of Pelikan-branded writing instruments in Malaysia, Singapore, China, Thailand and Greece.

Ikhlas Capital — a private equity firm founded by four individuals, including former CIMB Group Holdings Bhd chairman Tan Sri Nazir Razak — first surfaced as a shareholder in Pelikan in September 2019 when it acquired 54.84 million shares at 39 sen each through a private placement exercise, giving it a 9.09% stake.

Pelikan’s stock ended trading last Wednesday at 23.5 sen, translating into a market capitalisation of RM141.8 million.

Minister of Finance (Inc)-controlled Urusharta Jamaah Sdn Bhd (UJSB) ceased being a substantial shareholder in construction giant IJM Corp Bhd after hiving off a total of three million shares during the week in review.

UJSB had surfaced as a substantial shareholder in IJM in early November last year. Since then, IJM’s share price has gained about 29%, closing at RM2.42 last Wednesday and giving the company a market value of RM8.48 billion.

During the week in review, UJSB also ceased being a substantial shareholder of engineering outfit Eversendai Corp Bhd after selling 10 million shares. UJSB first surfaced in Eversendai in late 2018 with 40.29 million shares, or 5.16% equity interest.

Eversendai’s shares have gained 75% since end-February, hitting a four-year high of 39.5 sen on March 13, buoyed by the company bagging four contracts worth RM5.4 billion in total from Saudi Arabia, India and the United Arab Emirates.

Eversendai’s shares closed at 31.5 sen last Wednesday for a market capitalisation of RM246 million.

Recall that UJSB acquired the underperforming assets of pilgrim fund Lembaga Tabung Haji at the end of December 2018, forking out RM19.9 billion for assets that included parcels of land, commercial buildings, hotels, plantations and shares in 106 listed companies. UJSB forked out a 99% premium for the pilgrim fund’s assets and has been paring down its stakes in several of the companies.

At Hong Seng Consolidated Bhd, Dalphon Ltd — the vehicle of Datuk Seri Teoh Hai Hin — sold 99.5 million shares and ceased to be a substantial shareholder of the diversified group whose businesses include glove manufacturing, medical and healthcare supply, and moneylending.

Dalphon and Teoh emerged as substantial shareholders in Hong Seng in August 2022. Teoh was previously the managing director of Hong Seng but stepped down in July last year.

The stock ended at one sen last Wednesday, giving Hong Seng a market value of RM51.1 million. The company has suffered losses for six straight financial quarters.

Notable movements

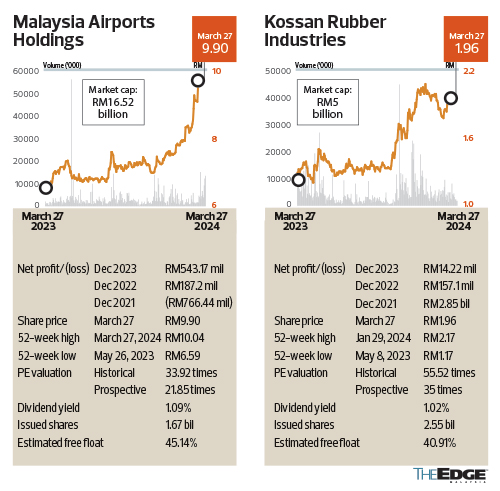

The share price of airport operator Malaysia Airports Holdings Bhd (MAHB) hit a historical high of RM10.04 in intraday trading last Wednesday and closed at RM9.90, translating into a market capitalisation of RM16.52 billion. Year to date, the counter has gained some 36%.

During this period of strength, the Employees Provident Fund (EPF) has been actively trading MAHB’s shares and was a net seller during the week in review, hiving off 203,000 shares to trim its stake to 6.75%, or 112.7 million shares.

The other pension fund, Kumpulan Wang Persaraan (Diperbadankan), or KWAP, sold 2.78 million MAHB shares during the week and reduced its stake to 6.81%, or 113.71 million shares.

In mid-March, MAHB announced that it had secured new operating agreements from the government, extending its management of Malaysia’s airports by another 35 years to Feb 11, 2069.

During the period in review, EPF snapped up 3.09 million shares in rubber glove maker Kossan Rubber Industries Bhd, strengthening its holding to 5.56%, or 141.79 million shares.

EPF surfaced as a substantial shareholder in Kossan in mid-February this year after accumulating 128.1 million shares, or 5.02% equity interest.

Kossan finished last Wednesday at RM1.96, having gained almost 48% since early November last year.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

| AIRPORT | 10.000 |

| BURSA | 7.460 |

| CIMB | 6.610 |

| HONGSENG | 0.015 |

| HONGSENG-PA | 1.740 |

| HONGSENG-WA | 1.180 |

| HONGSENG-WB | 0.005 |

| IJM | 2.420 |

| KOSSAN | 2.200 |

| PELIKAN | 0.230 |

| SENDAI | 0.385 |

Comments