Spotlight on Genting as Thailand eyes tourism dollars with casinos

This article first appeared in The Edge Malaysia Weekly on April 8, 2024 - April 14, 2024

THAILAND’S March 28 decision to legalise casinos housing large entertainment complexes naturally cast a spotlight on the Genting Group and its hilltop casino resort — Genting Highlands outside Kuala Lumpur — that opened its first hotel in 1971. The indoor and outdoor theme parks were added in the early 1990s. The Arena of Stars concert hall opened in 1998, a venue that has since hosted many local and international artistes.

With works for Genting Highlands some 6,000ft above sea level approved in the mid-1960s, about six decades ago, not many may realise Malaysia and the late Tan Sri Lim Goh Tong are among the region’s pioneers when it comes to integrated casino resorts.

Macau’s late casino king Stanley Ho opened his flagship Lisboa Casino Hotel in 1970. Ho, who opened his first casino resort in 1962 promising infrastructure investments and tourism promotion for Macau, also opened a casino in Pyongyang, North Korea, in 1995.

The former Portuguese colony, which in 2002 ended Ho’s four-decade monopoly by awarding several licences to foreigners, first overtook the Las Vegas Strip in gambling revenue in 2007. Helped by the return of tourists from mainland China, Macau — the only place in the country where casinos are legal — saw gross gaming revenue (GGR) in January 2024 recover more than 75% of that in January 2019. It reportedly expects gross gaming revenue to reach S$27 billion (RM94 billion) in 2024 — well ahead of Las Vegas.

Much of the growth in integrated resorts with casinos corresponded with the rise in spending capacity as the region went through strong economic growth. It also corresponded with the rise in outbound tourism among mainland Chinese to “approved destinations” in the region since the 1990s, expanding beyond approvals for Hong Kong and Macau in the 1980s.

Another early beneficiary of the trend was Hong Kong-listed NagaCorp Ltd’s late Malaysian founder Tan Sri Chen Lip Keong, who won Cambodia’s first casino licence in 1994.

Laos awarded licences to special economic zones with casinos in 2003, at least one of which was reportedly frowned upon by the Chinese authorities in 2011.

The Philippines, which has many casinos, gave licences for casino resorts in 2008 and 2009 as part of plans to turn itself into Asean’s top gaming and entertainment destination. Genting Hong Kong Ltd partnered with Philippine-based conglomerate Alliance Global Group to open Resorts World Manila (now known as Newport World Resorts) in August 2009, a venture Genting exited when the cruise ship operator went into liquidation in January 2022

following the impact of Covid-19.

Vietnam, which had long allowed foreigners-only prize-winning gaming entities, reportedly began allowing some Vietnamese on strict conditions at the Corona Phu Quoc casino that opened in January 2019.

With Thailand joining the fray and casino-hotels already legal in Myanmar, Indonesia and Brunei are the only two Asean nations silent on casino resorts. Sri Lanka has reportedly received 10 proposals for casino resorts that it says will attract tourists and raise state revenue.

Incidentally, it was a year ago in April 2023 that Japan approved plans to build the country’s first casino in Osaka, aimed at attracting domestic and international tourist spending. Expected to open by 2030, the winning consortium for MGM Osaka is owned by MGM Resorts International and local partner Orix Corp, which hold 40% equity interest each. The remaining 20% is held by local companies such as Panasonic, Kansai Electric Power and West Japan Railway.

Several casinos are already operating in South Korea, including the foreigner-only Paradise Casino Incheon Airport and Inspire Casino on Incheon’s Yeongjong Island.

The Thai Swift Singapore lesson

Having played the “integrated resort” card in 2006 (two opened in 2010) and relaunching the Singapore Grand Prix as the first Formula One night race to be held on a street circuit in Asia in 2008, Singapore is in the front line for top foreign tourist spending with exclusive live stage performances.

Taylor Swift, who made the Forbes’ billionaires list for the first time this year, thanks to her ongoing Eras Tour, is estimated to have boosted Singapore’s first-quarter gross domestic product (GDP) by 0.2 percentage points or S$300 million to S$400 million with her six sold out concerts until March 9. Some 70% of her 300,000 fans are estimated to be from the region. Singapore’s swift positioning captures the rise in experience-related tourism following the lifting of Covid-19 travel and large gathering curbs, with reports showing consumers putting more money into accommodation, transport and food rather than just pure shopping.

In a business forum on Feb 16, Thai Prime Minister Srettha Thavisin told participants that Singapore paid Swift US$2 million to US$3 million per show to ensure Singapore was her only stop in Southeast Asia. “If I had known this, I would have brought the shows to Thailand … Concerts can generate added value for the economy,” Srettha, who is also finance minister, was quoted as saying by the Bangkok Post.

Srettha’s office clarified that his comments to Thai businesses — that even a THB500 million (RM64 million) subsidy would have been worth it for the Thai economy and it would have been cheaper for Swift to organise a performance in Thailand and still attract sponsors — were expressing admiration for Singapore, calling it “a wise way of managing a country [and] something that Thailand should learn”.

Separately, a Philippine congressman reportedly called Singapore’s exclusivity bid a departure from good neighbourly relations.

Whatever one’s thoughts are, for heads of governments, it is ultimately about attracting tourism dollars and boosting corporate and consumer spending to bolster the nation’s economic growth. To protect locals, most governments promise safeguards to prevent vice and money laundering plus funding to address social issues often associated with gambling. Legalising casinos is also said to be a way of stamping out illicit operations through proper regulation and enforcement.

Tide turning for mainland Chinese tourists

As Thailand and other nations seek to bolster their competitive offerings to win currency inflows from foreign tourists, the other piece of news that stood out recently was China’s warning in March to its citizens in Singapore, South Korea and Sri Lanka to stay away from gambling which “may also bring risks such as fraud, money laundering, kidnapping, detention, trafficking and smuggling”.

“Even if overseas casinos are legally operated, cross-border gambling by Chinese citizens is suspected of violating the laws of our country,” Reuters quoted a March 18 statement by the Chinese embassy in Singapore, noting that the Chinese government “has always opposed any form of gambling and opposes Chinese citizens leaving the country to engage in gambling” and that its embassies and consulates may not be able to provide protection should there be violations.

In late February, the Chinese embassy in the Philippines said law enforcement agencies had cooperated to repatriate more than 40 Chinese nationals engaged in offshore gambling.

With Beijing reportedly attempting to discourage citizens from gambling, proponents of the Osaka casino are said to be working towards attracting locals as well as tourists from other parts of the region.

Impact on Genting Malaysia

Genting Malaysia’s highland Resorts World Genting — which sees less than 20% of its GGR come from foreigners — is expected to experience less impact from Thailand legalising the building of casinos, relative to Genting Singapore Ltd’s Resorts World Sentosa, where about 60% of its GGR is estimated to come from foreigners, according to Maybank Investment Banking Group Research analyst Yin Shao Yang.

The ratio of GGR from foreigners is almost 100% at NagaCorp’s Cambodia casinos, which are only for foreigners. Going forward, this may well be a factor for consideration by authorities when determining curbs on locals with money to spend.

Noting that entertainment complexes (EC) with casinos in Thailand are aimed at attracting tourists, Yin says the first of these may only open in 2029 if the authorities take two years to finalise a regulatory framework and another three years are needed to build the casinos.

“We understand that the favoured locations are in the Eastern Economic Corridor (Rayong, Chonburi, Chachoengsao), south (Phuket, Phang Nga, Krabi), north (Chiang Mai, Chiang Rai, Lampang) and northeast (Nong Khai, Udon Thani, Khon Kaen, Nakhon Ratchasima). These locations are also in the process of building or upgrading their airports (Eastern Economic Corridor, south), ports (Eastern Economic Corridor) and high-speed rail (north and northeast),” Yin wrote in a March 29 note, reiterating his “buy” call on Genting Malaysia with a target price of RM3.16.

He downplays concerns about the potential impact on Genting Malaysia. “Many who believed that Malaysian GGR would fall after the Singaporean integrated resorts opened in 1H2010 were proved wrong.”

There were 19.9 million visitors to Resorts World Genting in 2010, up from 19.5 million in 2009, while room nights sold eased to 2.67 million in 2010 from 2.76 million in 2009, according to data appended in Genting Malaysia’s annual reports.

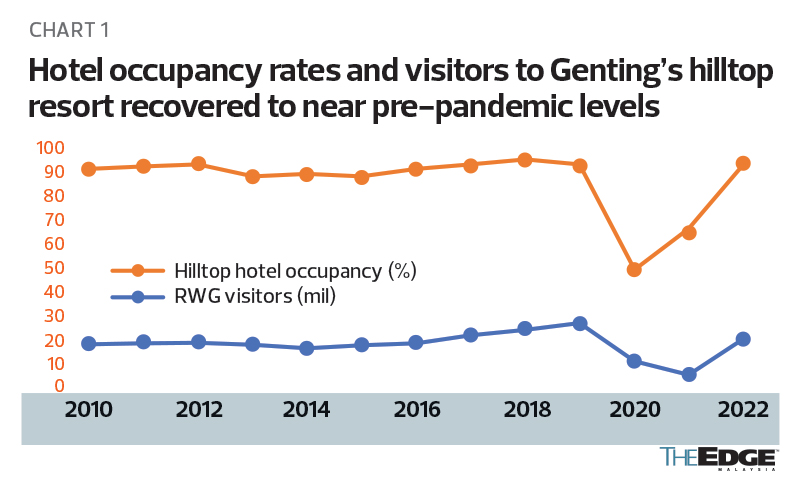

The number of visitors to the hilltop resort has continued to grow, reaching as high as 28.7 million in 2019 before dipping to 12.7 million in 2020 and 7.1 million in 2021, during the pandemic-hit years. In 2022, the number of visitors reached 22.2 million, or 77.4% of the high in 2019. In 2019, however, day-trippers made up 76% (compared with 71% to 73% between 2010 and 2018), with 24% being hotel guests.

Room nights sold at Resorts World Genting recovered to 2.37 million in 2022, about 67.8% of 3.5 million room nights in 2019 and 65% of as high as 3.63 million room nights in 2018. Hilltop hotel occupancy was 95% in 2022, the same as 2019, recovering from as low as 51% in 2020 and 68% in 2021, but is just shy of 97% in 2018 (see Chart 1).

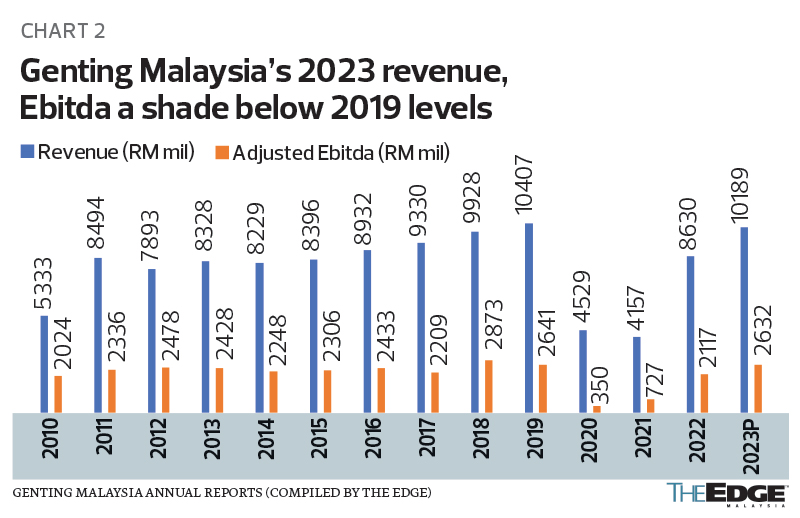

The Malaysian leisure and hospitality division accounted for 63% of Genting Malaysia’s revenue of RM10.19 billion and 78% of its Ebitda (adjusted earnings before interest, tax, depreciation and amortisation) of RM2.63 billion in FY2023. The rest of its revenue and earnings are from its operations in the UK and Egypt as well as those in the US and the Bahamas. Genting Malaysia’s FY2023 revenue is 98% while its adjusted Ebitda is 99.7% of FY2019 respectively (see Chart 2).

Noting that Genting Singapore has “even expressed interest in bidding for a Thai EC licence” and that both Genting Singapore and NagaCorp are investing billions to upgrade and expand their properties, Yin said “their eventual fates may be a lot less dire”.

Yin, who does not actively track NagaCorp, has a “buy” call on Genting Singapore with a target price of S$1.16. He also has a “buy” call on Genting Bhd, with a target price of RM5.73.

Genting Bhd owned 52.63% of Genting Singapore and 49.33% of Genting Malaysia as at March 2023, according to their respective 2022 annual reports. Group executive chairman Tan Sri Lim Kok Thay owned just over 44% of Genting Bhd via Kien Huat Realty Sdn Bhd and Kien Huat International Ltd.

Genting Malaysia paid a dividend of 15 sen per share for FY2022 and FY2023, which reflects a 5.5% yield at the stock’s closing price of RM2.71 on April 5. The dividend per share is down from 20 sen in FY2019.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments