This article first appeared in The Edge Malaysia Weekly on December 25, 2023 - December 31, 2023

The emergence of new shareholders in companies never fails to excite the market. This year, several shareholder changes left the market wondering why they were made as well as what the new players would do next at these companies.

Datuk Seri Mohamed Faroz Mohamed Jakel

Managing director of the Jakel Group

Datuk Mohamed Nizam Mohamed Jakel

Chief operating officer of the Jakel Group

The Jakel Group, led by Faroz and his brother Nizam, surprised the market this year when they emerged as substantial shareholders of Cypark Resources Bhd. The brothers, who are involved in textile trading and property development through the Jakel Group, are no strangers to the capital market. After all, they have emerged as shareholders in Sedania Innovator Bhd, TH Heavy Engineering Bhd, Scomi Group Bhd and Dataprep Holdings Bhd.

This time, though, their move signals to the market that it wants to have skin in the game in the renewable energy (RE) space. On Jan 4 this year, the Jakel Group’s investment arm Jakel Capital Sdn Bhd bought a 23.08% stake in Cypark via a private placement at 38 sen per share, or a total of RM67.13 million, making it the single-largest shareholder in the RE and solid waste management company. The brothers also acquired a direct 4.6% stake in Cypark on top of the 23.08% stake owned via Jakel Capital.

The investments are interesting, as Cypark was facing a myriad of issues at that time, including diminishing profitability and increasing debts, owing to a delay in projects, especially from its waste-to-energy plant in Negeri Sembilan and large-scale solar projects.

In January, shortly after Jakel took a substantial stake in Cypark, Nizam emerged as a substantial shareholder in Johor-based oil palm planter Harn Len Corp Bhd by injecting its privately owned plantation firm into Main Market-listed Harn Len for RM55 million in a cash-plus-shares deal.

It seems the Jakel Group is in the money on its investment in Cypark, given the surge in Cypark’s share price from 52 sen earlier this year to 95 sen on Dec 12. This was despite the company’s taking on a massive impairment for the February-to-April period, resulting in its maiden net loss of RM298.48 million since its listing. Furthermore, it has yet to deliver its solar farm projects that could boost the group’s RE assets to 400mw.

In fact, the brothers further reinforced their investment in Cypark, with Jakel Capital’s subscription of RM265 million of its Perpetual Sukuk Musharakah in September this year.

It will be very interesting to see what is next for the Jakel group in 2024, especially now that it has set up its own investment arm to spread its wings beyond the textile business. — By Intan Farhana Zainul

Datuk Au Yee Boon

Executive director of Prolexus Bhd and YB Ventures Bhd

Soon after apparel and textile firm Prolexus emerged as a substantial shareholder of South Malaysia Industries Bhd (SMI) in February this year, it initiated a move to remove all five board members in the latter via an extraordinary general meeting (EGM).

Prolexus, through Honsin Apparel Sdn Bhd and HIQ Media (M) Sdn Bhd, had acquired a 10.01% stake in SMI, which is involved in property development and wire manufacturing.

SMI claimed that the move was defective and a breach of laws, with no explanation provided for the removal of the directors. SMI also lodged a complaint with the Securities Commission Malaysia, alleging that more than 20 parties acting in concert had accumulated an equity stake exceeding 33% without making a mandatory general offer.

The High Court later struck out a suit by Prolexus’ subsidiaries to compel SMI to provide them with its record of depositors to call for an EGM, saying the units had abused the court process.

Businessman Au, 43, is the ultimate largest shareholder of Prolexus via his shareholding in YB Ventures Bhd (formerly known as Yi-Lai Bhd), which is involved in tile manufacturing and IT solutions.

YB Ventures is the biggest shareholder of Prolexus, with an indirect stake of 17.72%. Au holds the controlling equity interest in YB Ventures, with direct and indirect stakes of 4.51% and 8.33% respectively.

Au, who started his own retail business before establishing Techbase Solution Sdn Bhd in 2009, is an executive director in both Prolexus and YB Ventures.

Currently, Prolexus still owns a 7.48% stake in SMI, just behind Asian Pac Holdings Bhd’s direct and indirect stakes of 2.25% and 9.31% respectively.

SMI’s share price has more than halved since its peak of RM1.50, when Prolexus became its substantial shareholder. — By Lee Weng Khuen

Tan Sri Hamdan Mohamad

Chairman and CEO of Ranhill Utilities Bhd

In early November, it came as a surprise to many when YTL Corp Bhd surfaced as a substantial shareholder in water treatment, power and engineering player,

Ranhill Utilities Bhd, with an 18.87% stake, or 243.33 million shares. The block of shares was acquired by YTL Corp, via an auction, from Cheval Infrastructure Fund LP, which acted via its general partner, TAEL Management Co (Cayman) Ltd.

By end-November, the diversified YTL Corp, the flagship of the late Tan Sri Yeoh Tiong Lay and family, had upped its shareholding to 21.77%, or 280.73 million shares. Speculation of what would transpire heightened when Amran Awalauddin — a Ranhill Utilities executive director and long-time loyalist of Tan Sri Hamdan Mohamad, the patriarch, chairman and CEO of the company, with 31.42% equity interest — stepped down “to pursue personal interests”, the Bursa Malaysia announcement read. So far, no replacements for Amran, who had been with Ranhill Utilities since 1999, have been made on the board of the company.

In the meantime, Ranhill Utilities, via an open tender, snagged a RM283.89 million contract in Johor for the reduction of non-revenue water (NRW) from January 2024 to December 2026, or a three-year time frame. This is the seventh consecutive NRW contract that Ranhill Utilities has secured since 2011, and the company has played a key role in reducing Johor’s NRW from 37% in 2005 to just above 25% now.

The key question is whether Hamdan— who is in his late 60s and synonymous with the Ranhill brand — will make way for YTL Corp, which is similarly involved in water treatment and power generation, among a host of other businesses. YTL Corp’s assets include Wessex Water Ltd, which has large water and sewerage operators in the UK; PowerSeraya Pte Ltd in Singapore; and a 20% stake in PT Java Power, which owns a 1,220mw coal-powered power plant in East Java, Indonesia, among others. In a nutshell, Ranhill could be a good fit for YTL Corp.

As a result of the speculation of what may transpire at Ranhill Utilities, its stock has surged, gaining close to 51% since late October this year. The company has been performing, chalking up net profits of RM33.4 million on the back of RM1.72 billion in revenue for its nine months ended September this year. For the corresponding period a year ago, the company registered net profits of RM23.7 million on RM1.28 billion in sales.

Besides Hamdan, other substantial shareholders in Ranhill Utilities are UOB Kay Hian Pvt Ltd, which holds a 9.1% stake for Singapore’s United Overseas Bank Ltd, and the state government of Johor, with 9.07% equity interest. Other notable shareholders as at end-March this year included pilgrim fund Lembaga Tabung Haji, with 4.22% shareholding, and state-controlled YPJ Corp Sdn Bhd, with 2.72%.

What does YTL Corp hope to achieve with its investment in the Johor-based Ranhill Utilities?

YTL Corp had net debts of RM31.5 billion as at end-September. At its close of RM1.93 last Tuesday, it had a market capitalisation of RM21.3 billion. In contrast, Ranhill Utilities was just above the RM1.1 billion band but worth much more than it was just before the emergence of YTL Corp, as its share price moved in response to the development.

What transpires next at Ranhill Utilities will be closely followed. — By Jose Barrock

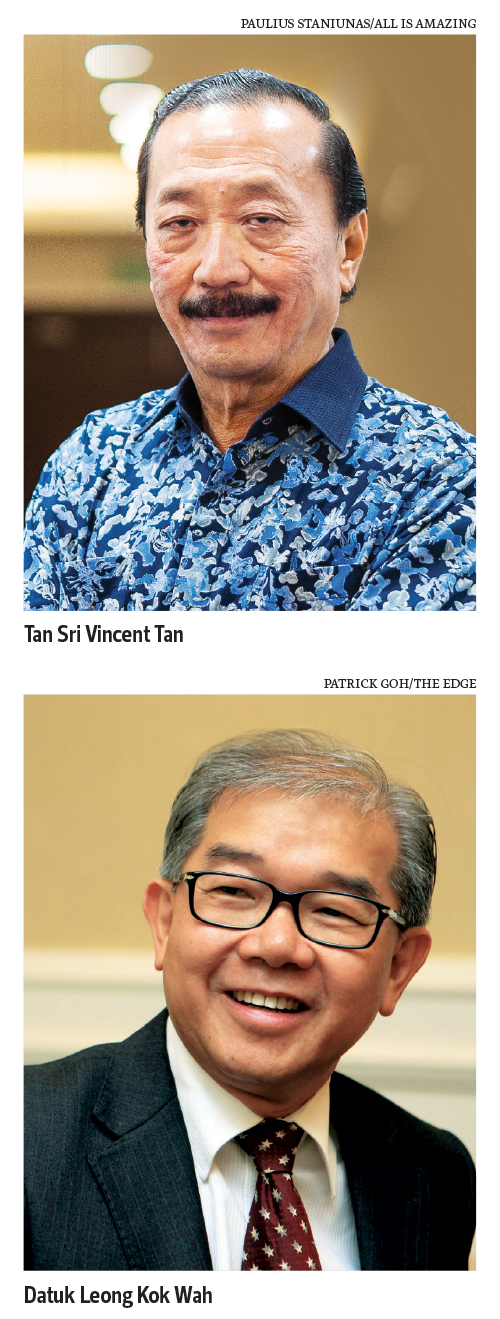

Tan Sri Vincent Tan

Founder of Berjaya Corp Bhd

Datuk Leong Kok Wah

Executive director of Salcon Bhd

Berjaya Corp Bhd (BCorp) has been embarking on its transformation plan, which includes the disposal of non-core assets such as the recent sale of its wastewater management firm Berjaya Enviro Holdings Sdn Bhd to Naza Corp Holdings Sdn Bhd for RM700 million.

This was followed by the conglomerate’s emergence as Salcon Bhd’s substantial shareholder, with a 5.43% stake in early November.

Since then, BCorp has been accumulating more shares in the water and wastewater engineering firm, bumping up its shareholding to 14.54% as at Nov 20. As a result, BCorp is now the single largest shareholder of Salcon.

Salcon’s other substantial shareholders are executive deputy chairman Tan Sri Tee Tiam Lee (12.55%), executive director Datuk Leong Kok Wah (10.58%), and non-independent and non-executive director Datin Goh Phaik Lynn (10.58%). Both Tee and Leong have been on the Salcon board for more than a decade.

Salcon slipped into the red with a net loss of RM23.96 million for the financial year ended Dec 31, 2022 (FY2022), against a net profit of RM11.97 million in FY2021. It incurred a net loss of RM6.22 million in 9MFY2023.

Shares in Salcon nearly doubled to 36 sen in mid-November from 19 sen at end-October. The stock pared some gains to close at 27 sen on Dec 12.

So far, there has been no appointment of representatives from BCorp to the Salcon board. It remains to be seen whether BCorp would want to participate in Salcon’s day-to-day operations or the stake acquisition is purely an investment decision.

Tan stepped down as non-executive chairman of BCorp in March to assume the role of adviser, following the setting up of an all-female board in the group.

On the other hand, what is his game plan for Salcon? — By Lee Weng Khuen

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.