Cover Story: Will 2024 see another dividend windfall?

This article first appeared in The Edge Malaysia Weekly on March 11, 2024 - March 17, 2024

A sizeable pool of Bursa Malaysia’s largest companies and known good dividend payers delivered bumper dividends to shareholders — including government-linked investment companies (GLICs) — on the back of improved financial performance in 2023. A majority gave higher dividends in FY2023 versus FY2022, and a handful paid dividends for the first time in years.

For example, the six GLICs collected RM18 billion from their top 50 holdings in FY2023 — up RM1.5 billion from the RM16.5 billion paid out by these companies in FY2022. This improvement was partly due to special dividends from bigger companies, such as CIMB Group Holdings Bhd and IHH Healthcare Bhd.

In FY2023, slightly more than half of the 957 Bursa Malaysia-listed companies identified by The Edge were dividend payers, two-thirds of which have analyst coverage.

It would seem, though, that the dividend harvest is still aplenty in FY2024, though it may not be as bountiful as FY2023.

For FY2024, at least 264 companies under analysts’ coverage are expected to continue rewarding shareholders with dividends, according to data extracted by The Edge from AsiaAnalytica and Bloomberg.

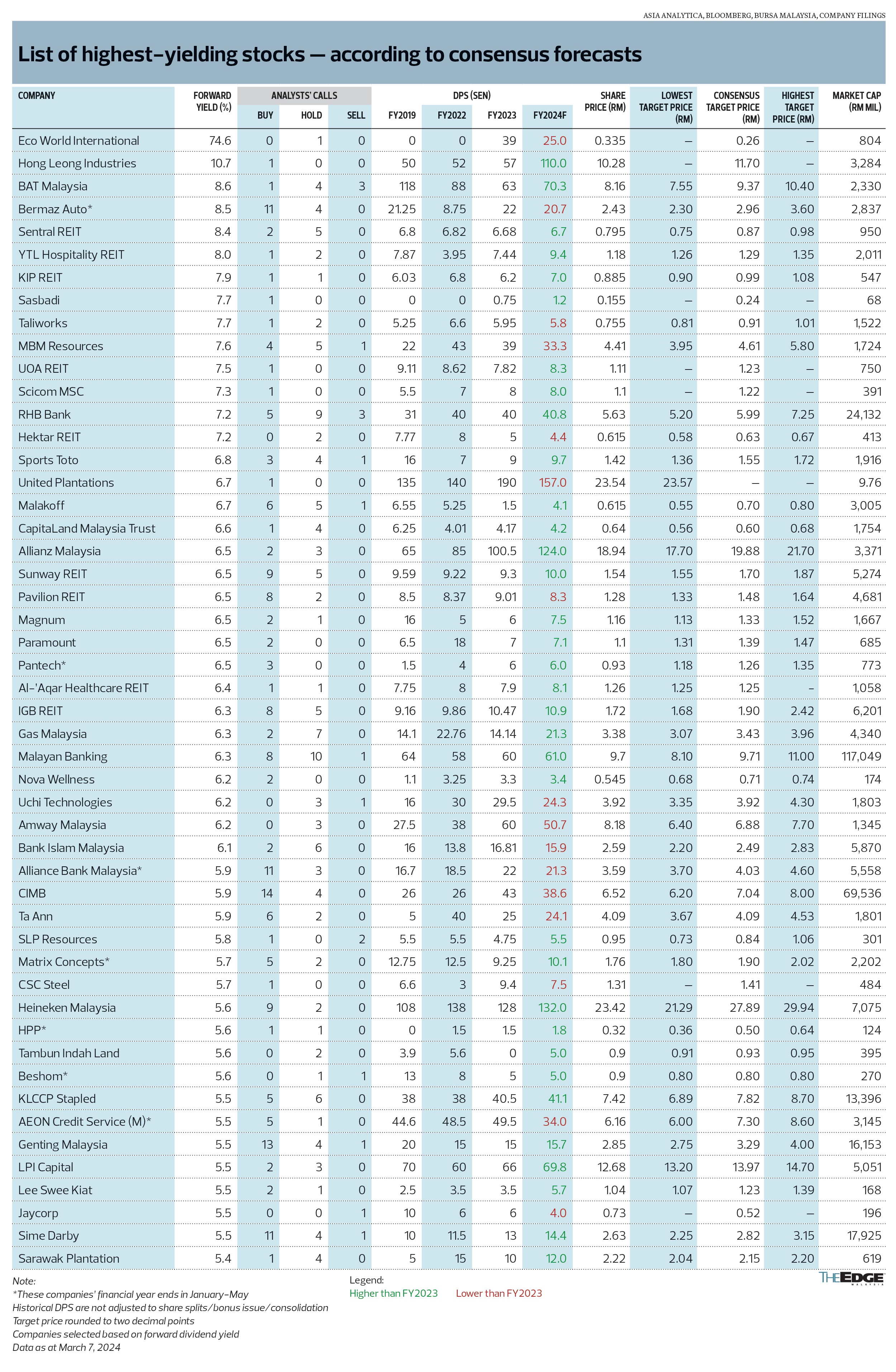

At least 25%, or 67 companies, carry a 5% forward yield based on their March 7 close.

Indicative yields are more than 6% at 32 companies, above the 5.5% dividend declared by the Employees Provident Fund (EPF) and the 5.25% yield from Amanah Saham Bumiputera for 2023.

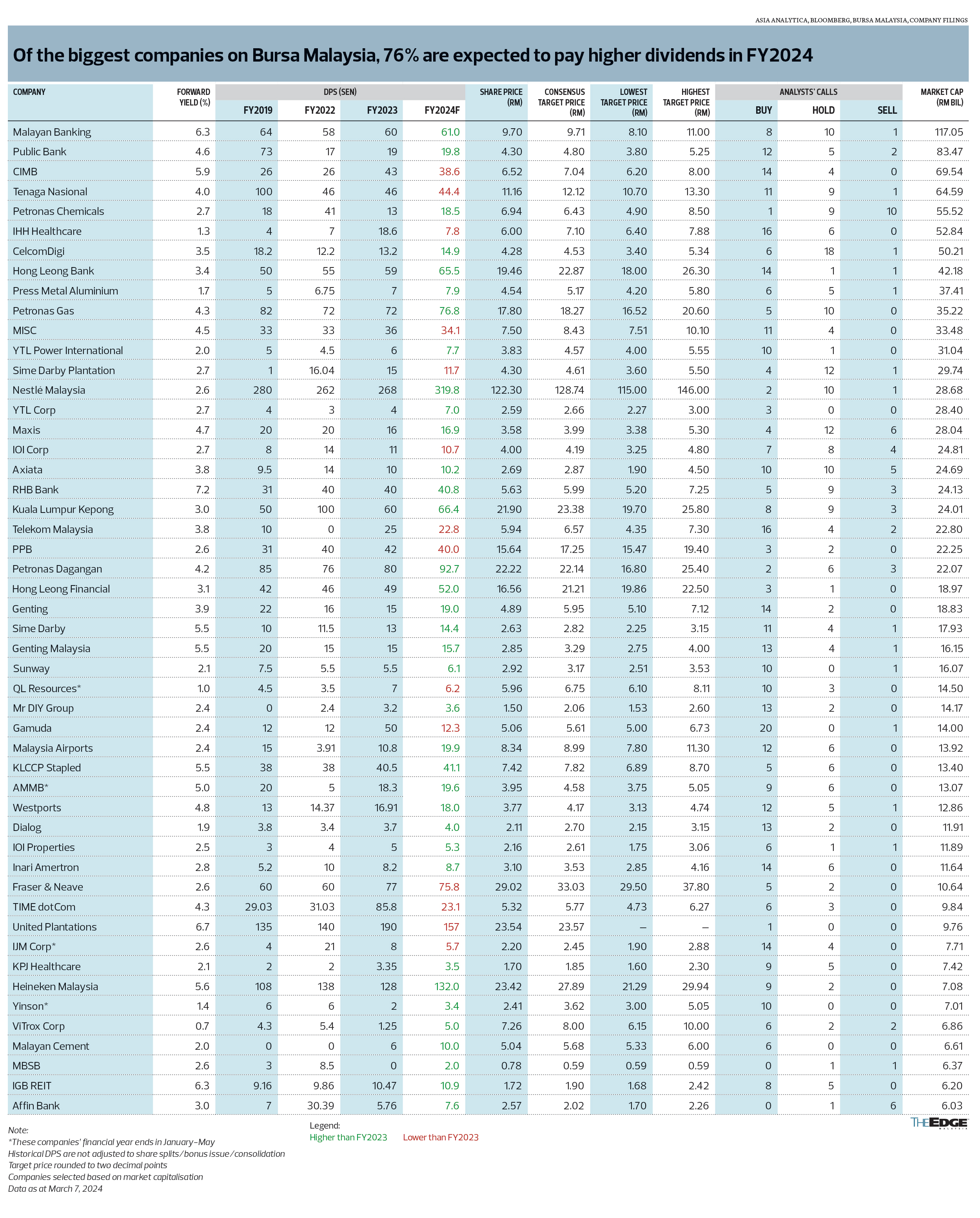

Of the top 50 dividend-paying companies on Bursa Malaysia by market capitalisation, 38 are still expected to pay a higher year-on-year dividend per share (DPS) in FY2024, compared with 31 in FY2023, according to analysts’ forecasts at the time of writing. This is despite a declining trend in special dividend payouts.

Across Bursa Malaysia, 12 companies have announced special dividends so far this year (all for FY2023). A total of 37 companies declared special dividends in calendar year 2023 compared with 45 in 2022, 54 in 2021, 38 in 2020 and 35 in 2019.

The biggest annual increases in dividends are expected to come from YTL-linked companies — YTL Power International Bhd (28% y-o-y from FY2023) and Malayan Cement Bhd (66% y-o-y) — amid good prospects as upstream players in electricity and construction respectively.

This payout is expected to trickle down to benefit the shareholders of their listed parent YTL Corp Bhd, whose FY2024 dividends are expected to rise in tandem by 75% y-o-y.

Having said that, yields for these companies are on the lower side of below 3%, as their share prices have caught up with their prospects, with both YTL Power and YTL Corp having made a comeback as FBM KLCI components after more than a decade.

Big caps with dividend recovery include fuel retailer Petronas Dagangan Bhd (PetDag) (4.2% yield) and CelcomDigi Bhd (3.5%), as well as tourism proxy Genting Bhd (3.9%). Genting’s DPS has yet to return to pre-pandemic levels.

Looking ahead, however, each has its own risks — such as the targeted subsidy mechanism for PetDag; clarity on the 5G playing field for CelcomDigi; as well as concerns about recovery for Genting, after its Singapore operations disappointed.

Analysts are also looking at a rebound in Petronas Chemical Bhd’s dividend payout to 18.5 sen per share (3% yield), from 13 sen in FY2023, when it was dragged lower by the downturn in petrochemical prices and weaker demand from China. Despite the attractive yield, half of the analysts who cover the stock still had a “sell” call on it at the time of writing. The Petronas-linked outfit paid 41 sen per share in FY2022 and 18 sen in FY2019.

High-yielding stocks

The Edge also looked at companies with the biggest forward yields.

Ten of these counters are real estate investment trusts (REITs) — most of which are expected to pay more (compared with both FY2023 and pre-pandemic) — and led by Sentral REIT, YTL Hospitality REIT and KIP REIT. Each is overweight in different segments, that is, offices, hotels and resorts, and retail outlets.

Sin stocks, too, have high forward yields. They include British American Tobacco (M) Bhd (BAT) (8.6%), Sports Toto Bhd (6.8%), Magnum Bhd (6.5%), Genting Malaysia Bhd (5.5%) and Heineken (5.6%).

Save for Heineken — a top pick among sin stocks — none of the counters are back to pre-pandemic levels in terms of dividends, as discretionary spending still has room to recover, while BAT is facing a long-term downward trend from vapes and counterfeits.

Heineken’s peer, Carlsberg Brewery M Bhd, is also a “buy”, with eight such calls against three “hold”, but its forward yield is narrower at 5.1%, based on its DPS forecast of 95.6 sen against its March 7 closing of RM18.64.

Among the biggest-yielding stocks today is Eco World International Bhd (76%), which is focusing on clearing its existing stock for a targeted 21 sen per share in dividends over the next two years. It declared 39 sen in dividends for FY2023.

Other top picks include auto-linked counters Sime Darby Bhd (5.5%, with a core distribution business in China being the wild card), as well as Bermaz Auto Bhd (8.5%) and Perodua proxy MBM Resources Bhd (7.6%) — although dividends from the latter two have peaked from 2022 levels, owing to an absence of incentives that spurred car purchases in recent years.

From a dividend sustainability perspective, Sime Darby is among those with steady growth in dividends over the years, alongside the likes of Westports Holdings Bhd, Public Bank Bhd (4.6%), Hong Leong Bank Bhd (3.4%) and Hong Leong Financial Group Bhd (3.1%).

Smaller-cap companies with steady historical dividend growth include business process outsourcing provider Scicom MSC Bhd (7.3%), insurance outfit Allianz Malaysia Bhd (6.5%), pipe and valve manufacturer Pantech Group Holdings Bhd (6.5%), supplements company Nova Wellness Group Bhd (6.2%), plastic packaging outfit SLP Resources Bhd (5.8%) and regional mattress manufacturer Lee Swee Kiat Group Bhd (5.5%).

Share prices yet to catch up

Areca Capital CEO Danny Wong says: “In general, the earnings outlook is getting better, with expectations of [interest] rate cuts and recovery of consumption.”

This will show in sectors such as tourism and electrical and electronics (E&E), he says — two sectors that have yet to fully recover (based on FY2023 performance), owing to external headwinds such as interest rate upheavals and China weakness.

The high yields reflect the share price lag in local equities, MIDF Research head Imran Yassin Md Yusof tells The Edge.

While the FBM KLCI is up 5% this year, it was a laggard in 2023 with a 2.4% decline. Meanwhile, the FBM ACE Index is down 12% this year.

“Our expectations for KLCI FY2023 earnings growth is around 9.6%. So, definitely there’s a case for higher dividends,” Imran says. Another consideration is the return of Malaysia’s external trade, which contracted in 2023, coupled with domestic demand, which he still deems resilient.

Other sector players that “may be compelled to pay out higher dividends” are exporters, says former dealer Ian Yoong.

“Listed companies in Malaysia that are mainly exporters will report higher profitability because of ringgit weakness,” he says.

Still, while yields are high, one thing on investors’ minds may be comparative returns.

“In a regime of high interest rates, fixed income securities such as bonds are yielding 5% to 9% per year (depending on the rating), and holders get back the principal amount upon maturity,” says Yoong.

There are certainly many things for investors to consider, amid uncertainty in the pace of interest rate pivots, risk of recession, geopolitical tensions, and direction of currencies.

Based on the potential returns from dividend-yielding Bursa Malaysia-listed counters, however, those who are open to increasing exposure towards Malaysian equities are spoilt for choice.

In seeking out bargains, one may want to look more closely at companies with GLIC owners. All in, 52 of the 90 good dividend payers that The Edge looked at paid more dividends in 2023, and 34 of the 52 have GLICs as substantial shareholders (see “Less dividends seen for GLICs in 2024 as special payouts wane” on Page 56).

For FY2024, 38 of the 61 companies that may pay more dividends in 2024 have GLICs as substantial shareholders.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

| ALLIANZ | 20.900 |

| BAT | 8.200 |

| BAUTO | 2.320 |

| BURSA | 7.460 |

| CDB | 4.180 |

| CIMB | 6.610 |

| EWINT | 0.355 |

| FBMACE | 5062.010 |

| FBMKLCI | 1575.160 |

| GENM | 2.600 |

| GENTING | 4.490 |

| HLBANK | 19.260 |

| HLFG | 16.840 |

| IHH | 6.270 |

| LEESK | 0.910 |

| MAGNUM | 1.140 |

| MBMR | 4.840 |

| MCEMENT | 5.010 |

| NOVA | 0.520 |

| PANTECH | 1.070 |

| PBBANK | 4.210 |

| PETDAG | 21.840 |

| REIT | 833.530 |

| SCICOM | 1.080 |

| SENTRAL | 0.800 |

| SIME | 2.810 |

| SLP | 0.950 |

| SPTOTO | 1.400 |

| WPRTS | 3.930 |

| YTL | 3.030 |

| YTLPOWR | 4.420 |

| YTLREIT | 1.190 |

Comments